Will Mortgage Rates Drop in 2026? What Buyers and Sellers in Rhode Island Should Expect

Are mortgage rates finally heading lower in 2026—or is the housing market settling into a new normal?

That’s the question buyers and sellers across Warwick, Cranston, East Greenwich, and the rest of Central Rhode Island are asking as they plan their next move.

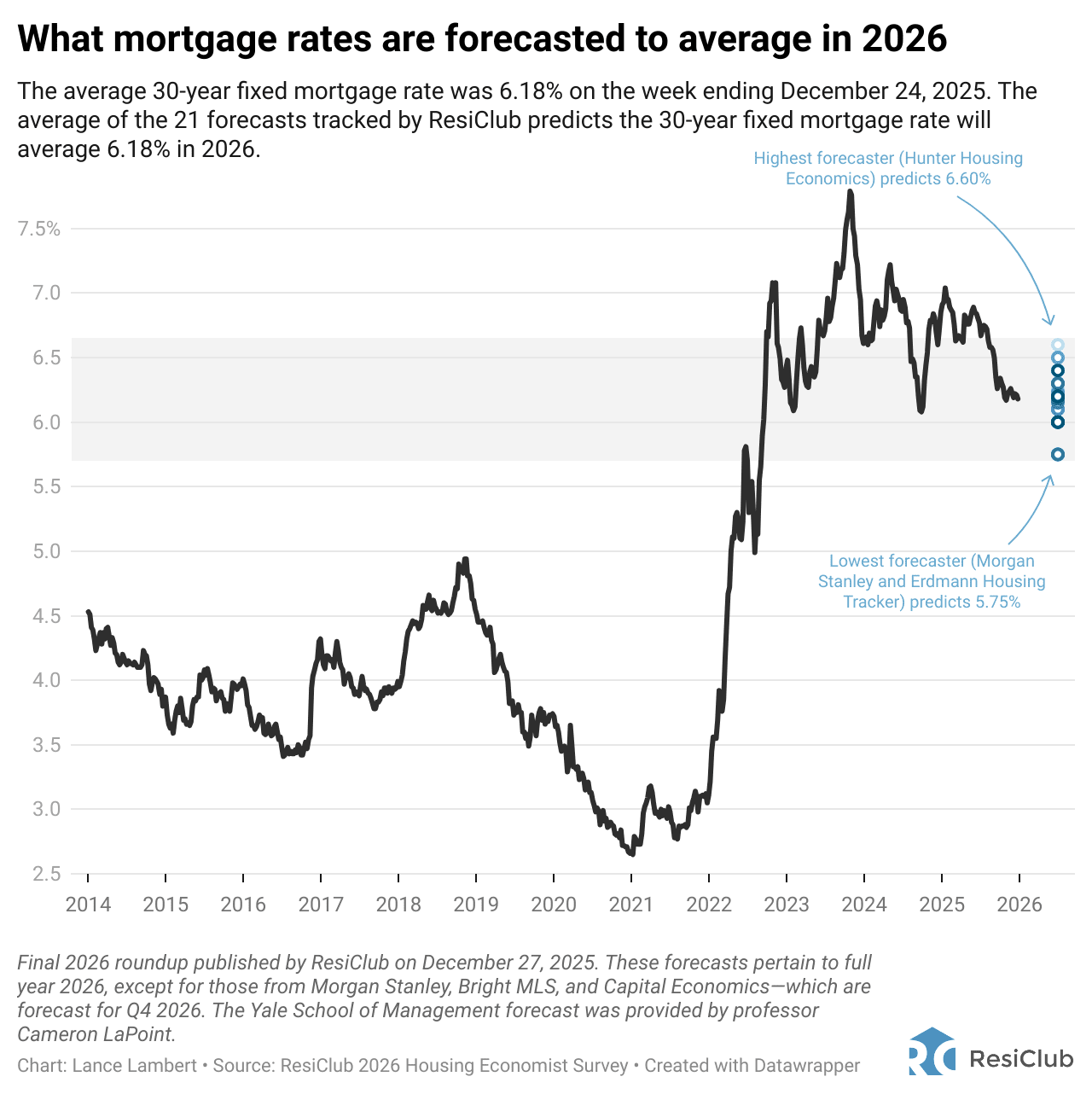

Based on forecasts from 21 major housing and economic research groups, the consensus view is surprisingly clear: mortgage rates in 2026 are expected to hover around the low-6% range, not dramatically higher or lower than where we are today. The average prediction comes in at about 6.18% for the full calendar year.

Below, we’ll break down what those national forecasts really mean for Rhode Island home buyers, sellers, and homeowners, how much confidence to place in rate predictions, and how to plan strategically—regardless of where rates land.

A Reality Check: Why Mortgage Rate Forecasts Are So Tricky

Mortgage rate forecasting has been especially difficult over the past few years. Many economists significantly underestimated rates in 2022, 2023, and 2024 following rapid inflation, aggressive Federal Reserve policy, and global economic shocks.

Recently, however, forecasts have become more accurate. Heading into late 2025, most economists expected rates to average the mid-6% range—and that’s exactly where they landed.

That improved accuracy gives today’s 2026 forecasts more credibility, even though no prediction is guaranteed.

The Big Picture: Where Experts Expect Mortgage Rates in 2026

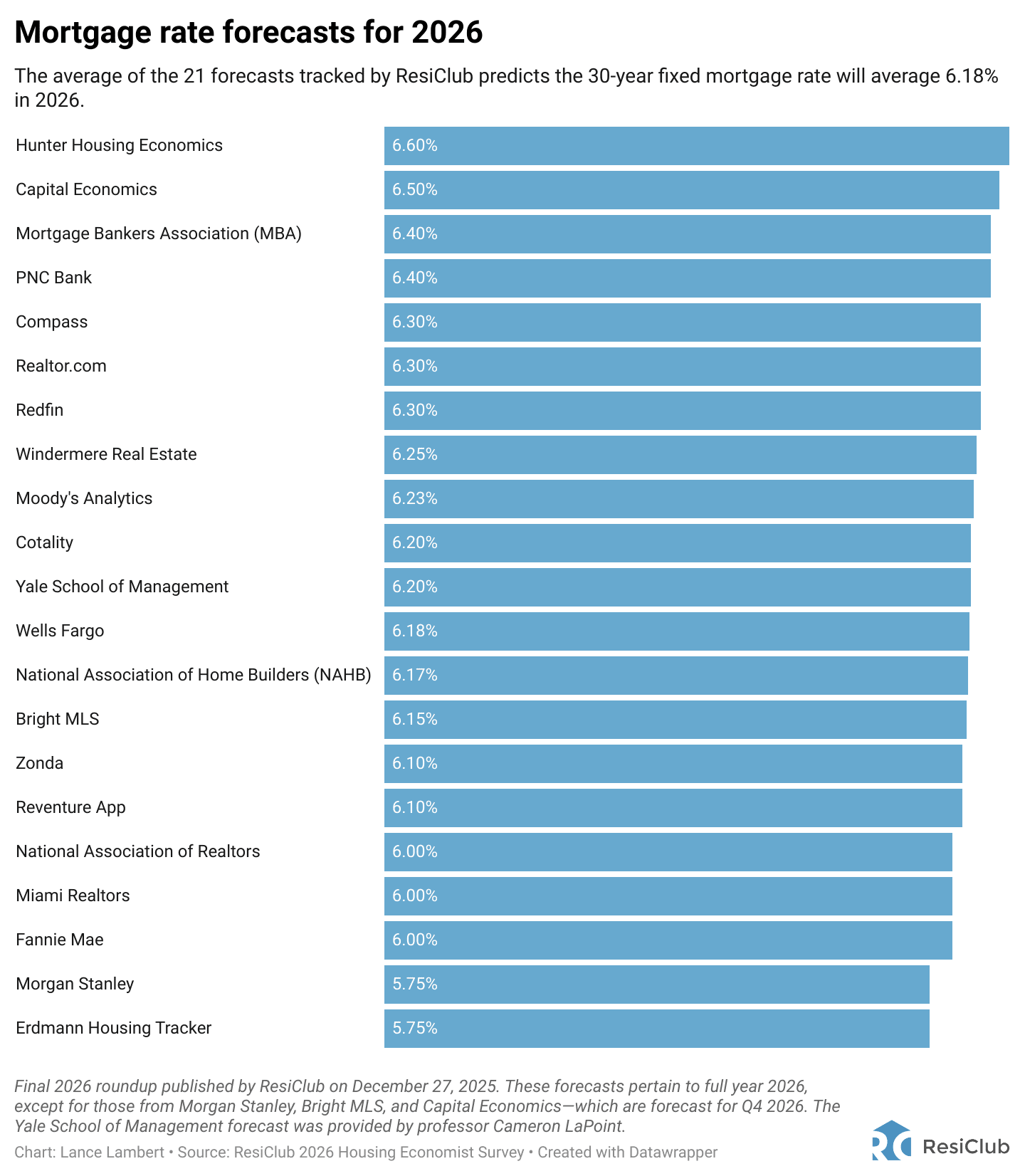

Across all 21 forecasts surveyed:

Average 2026 mortgage rate: ~6.18%

Highest forecast: ~6.60%

Lowest forecast: ~5.75%

Most predictions cluster between: 6.0%–6.4%

Groups such as the Mortgage Bankers Association, Fannie Mae, National Association of Realtors, and major Wall Street firms all point to gradual easing—not a sharp drop.

In short: economists are forecasting stability, not a return to 3–4% rates.

Why Rates Are Expected to Stay in the Low-6% Range

Several forces are keeping mortgage rates from falling quickly:

1. Inflation Isn’t Fully Tamed

While inflation has cooled from its peak, it hasn’t disappeared. As long as inflation remains above the Federal Reserve’s 2% target, long-term interest rates—including mortgages—are unlikely to plunge.

2. The Economy Is Slowing, Not Collapsing

Most forecasts assume the U.S. avoids a deep recession. That limits how aggressively the Fed can cut rates.

3. Bond Markets Matter More Than the Fed

Mortgage rates are driven largely by long-term bond yields, not just short-term Fed decisions. Even if the Fed cuts rates modestly in 2026, mortgage rates may only drift slightly lower.

4. The “Mortgage Spread” Could Normalize

One potential tailwind: the gap between the 10-year Treasury yield and mortgage rates is still wider than its long-term average. If that spread narrows, mortgage rates could fall modestly—even without major economic weakness.

What This Means for Buyers in Warwick & Central Rhode Island

If you’re planning to buy a home in 2026, here’s what to expect:

✔ Affordability Improves—But Slowly

Rates near 6% are better than the highs of recent years, but still significantly higher than pre-2022 levels. Monthly payments remain the primary affordability challenge.

✔ Less “Waiting for Rates” Competition

Many buyers are no longer waiting for a dramatic rate drop that may never come. That means more consistent demand, especially for well-priced homes in Warwick, Cranston, and North Kingstown.

✔ Strategy Matters More Than Timing

Rather than trying to perfectly time rates, successful buyers are:

Negotiating seller credits

Exploring rate buydowns

Focusing on long-term affordability, not headlines

What Sellers Should Know About the 2026 Rate Outlook

For homeowners considering selling:

✔ The Lock-In Effect Will Ease Gradually

Many homeowners still have mortgage rates below 5%. As rates stabilize closer to 6%, the psychological and financial gap narrows, allowing more move-up and downsizing sellers to re-enter the market.

✔ Pricing Will Matter More Than Ever

With affordability still tight, buyers are price-sensitive. Homes that are well-priced and well-presented will continue to sell—others will sit.

✔ Inventory Should Improve (Modestly)

Don’t expect a flood of listings, but more balanced conditions are likely compared to the ultra-tight markets of 2023–2024.

What Could Push Mortgage Rates Lower Than Expected?

There is a wildcard scenario:

A sharper-than-expected economic slowdown

Rising unemployment

Faster-than-anticipated inflation cooling

If those occur, mortgage rates could dip below baseline forecasts for part of 2026. However, most economists view that as possible—but not the base case.

The Bottom Line for Rhode Island Real Estate in 2026

Mortgage rates in 2026 are expected to:

Stay around 6%

Move within a normal annual range

Improve affordability incrementally, not dramatically

For buyers and sellers in Warwick and across Central Rhode Island, this points to a market driven less by rate speculation—and more by life decisions, pricing strategy, and smart planning.

Thinking About Buying or Selling in 2026?

Whether you’re buying your first home, selling a longtime property, or weighing whether it makes sense to move at today’s rates, local strategy matters more than national averages.

📞 Talk with Nick Slocum or a top agent at The Slocum Home Team | eXp Realty to get a personalized plan based on your goals, your timeline, and real conditions in the Rhode Island market.