Will Existing Home Sales Finally Rebound in 2026? What Buyers and Sellers Should Expect

If you’re a homeowner or buyer in Warwick, East Greenwich or anywhere in Rhode Island, you’ve probably asked this question recently: Are we finally past the slowdown in home sales—and will 2026 feel any different?

National forecasts suggest a cautious answer. While economists don’t expect a dramatic rebound, many do believe the existing-home market may be stabilizing and inching toward recovery. Understanding what that means nationally—and how it translates locally—can help you make smarter real estate decisions over the next year.

Below, we break down what leading housing forecasts are signaling for U.S. existing home sales in 2026, why activity has remained historically low, and what this outlook could mean for buyers and sellers across Warwick, Cranston, East Greenwich, Coventry, North Kingstown, and greater Rhode Island.

A Quick Look Back: Why Home Sales Fell So Sharply

During the pandemic housing boom, existing-home sales surged nationwide. Ultra-low mortgage rates allowed homeowners to sell and buy again with ease, while buyers—both owner-occupants and investors—quickly absorbed available inventory.

That momentum came to an abrupt halt in 2022.

As mortgage rates rose rapidly, existing-home sales dropped to levels not seen in decades. The main culprit wasn’t demand alone—it was reduced housing turnover, often referred to as the lock-in effect.

What Is the Lock-In Effect?

Many homeowners secured mortgage rates in the 2–4% range during 2020–2021. Selling now often means:

Giving up a significantly lower monthly payment

Replacing it with a mortgage that may be several hundred dollars more per month

Or, for some households, no longer qualifying at today’s rates

As a result, fewer people are listing homes—even if they’d otherwise like to move.

National Existing-Home Sales: Where We Stand Now

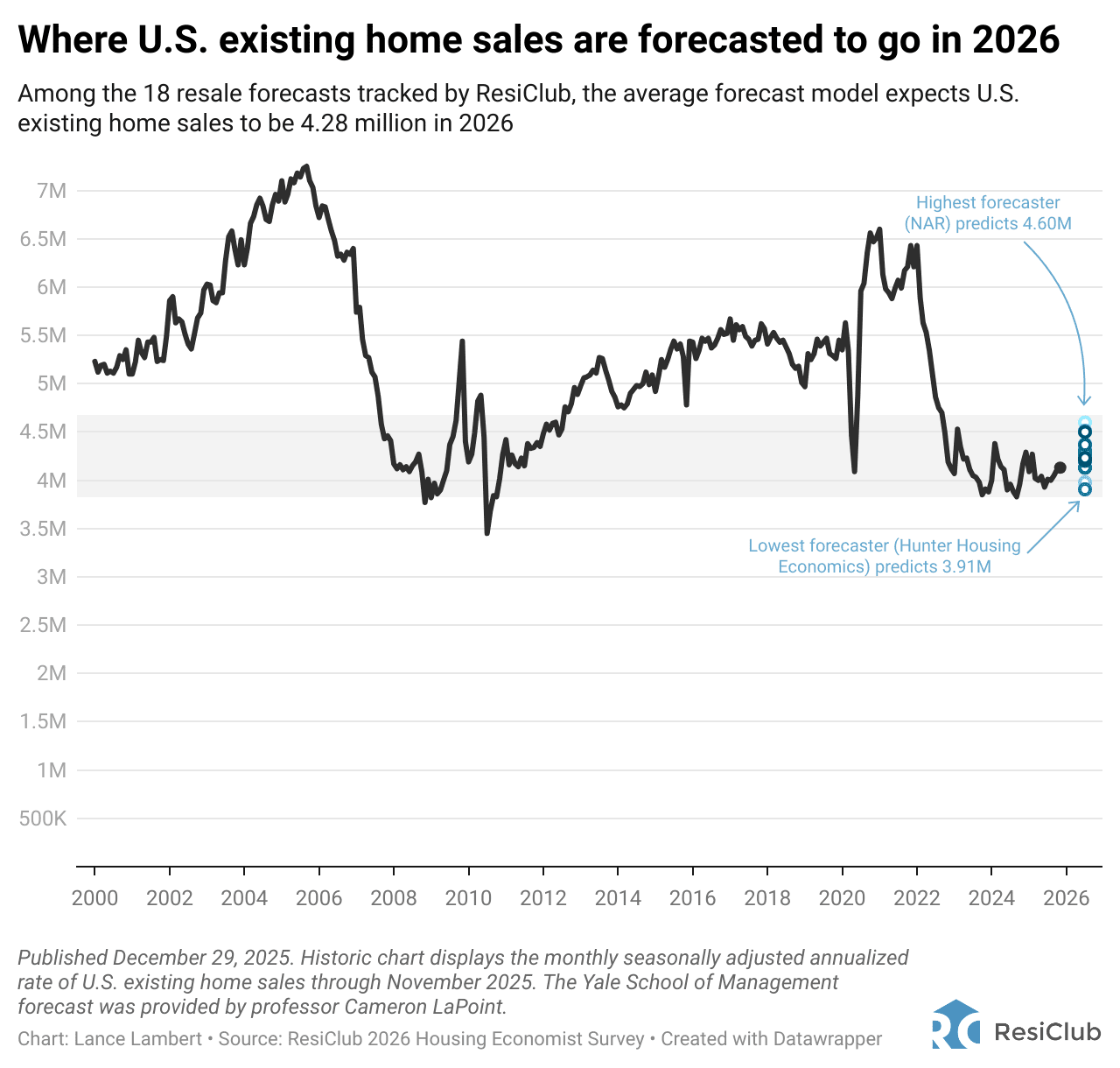

To understand where the market may be heading, it helps to look at where it’s been. Over the past several years, annualized existing-home sales have shifted dramatically:

2019–2021: Strong, above-average activity

2022–2023: A sharp correction as rates surged

2024–2025: Sales stabilized, but at historically low levels

By late 2024 and into 2025, sales volumes appeared to stop falling—but they haven’t meaningfully rebounded either.

That leads to the big question heading into 2026.

What Forecasts Are Predicting for 2026 Existing-Home Sales

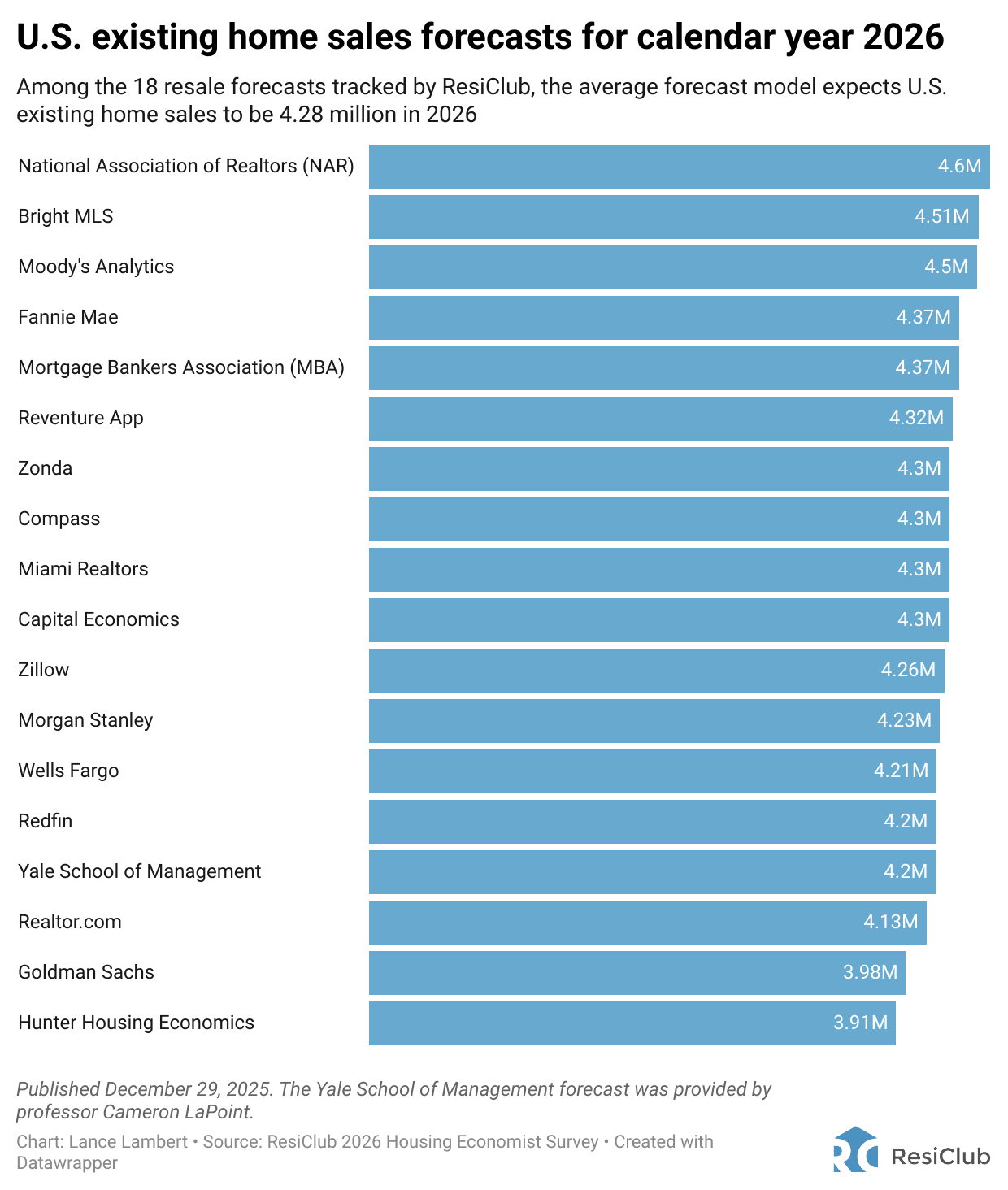

Across a wide range of economic and housing forecast models, expectations for 2026 are modestly optimistic—but restrained.

The Consensus Outlook

Average forecast for 2026 U.S. existing-home sales: ~4.3 million

That would represent a slight increase from 2025

Still well below pre-pandemic “normal” levels

In other words, many analysts believe the market may have passed its lowest point, but the recovery is expected to be slow and uneven.

Some models that extend further out anticipate a bit more momentum by 2027, with sales edging closer to the mid–4 million range nationally.

Why Forecasters See Slight Improvement in 2026

While no one is predicting a return to the frenzied market of 2020–2021, several factors could gradually support higher resale activity.

1. Life Happens—Even With Low Mortgage Rates

Over time, lifestyle changes accumulate:

Growing families

Job relocations

Downsizing or retirement

Health or caregiving needs

As incomes rise and circumstances change, more homeowners may decide that staying put no longer outweighs their low-rate mortgage.

2. Marginally Lower Mortgage Rates (Not a Collapse)

Most forecasts do not assume a dramatic drop in rates. However, many expect:

Rates in the 2026 spring market to be modestly lower than in spring 2025

Slightly improved affordability at the margins

Even small rate improvements can unlock demand for both move-up buyers and first-time purchasers.

3. Buyers Adapting to the “New Normal”

After several years of elevated rates:

Buyers have adjusted expectations

Households are recalibrating budgets

Creative solutions (rate buydowns, smaller homes, different locations) are becoming more common

This adaptation process tends to support slow, steady gains in transaction volume.

What This Means for Rhode Island Homeowners

National data sets the tone—but local markets don’t move in lockstep with national averages.

In Central Rhode Island, several dynamics continue to shape the outlook:

Inventory Remains Tight

Warwick, Cranston, East Greenwich, and surrounding towns still face:

Limited resale inventory

Few move-in-ready homes

Strong competition for well-priced listings

Even with lower national sales volume, desirable Rhode Island neighborhoods continue to attract buyers.

Prices May Stay More Stable Than Sales Volume

Low transaction volume does not automatically mean falling prices. In many Rhode Island communities:

Supply constraints remain severe

Sellers who do list often receive solid interest

Pricing corrections, where they occur, tend to be modest and localized

Sellers Have Leverage—If They Price Correctly

If you’re considering selling in 2026:

Homes that are priced accurately and presented well can still perform strongly

Overpricing, however, is less likely to be forgiven in a slower national environment

What This Means for Buyers in 2026

For buyers, the 2026 outlook offers both challenges and opportunities:

Potential Advantages

Less frantic competition than peak pandemic years

More time for due diligence

Occasional negotiating room, depending on the property

Ongoing Challenges

Limited selection in many Rhode Island towns

Higher monthly payments compared to pre-2022 norms

Need for careful financial planning

Working with a knowledgeable local agent becomes especially important in a market defined by nuance rather than headlines.

So, Is 2026 the Turning Point?

The short answer: Possibly—but don’t expect fireworks.

Most forecasts point to:

A market that has stabilized

Gradual improvement rather than a surge

Continued constraints from low inventory and homeowner lock-in

For Rhode Island buyers and sellers, success in 2026 will be less about timing the market perfectly—and more about strategy, preparation, and local expertise.

Thinking About Buying or Selling in Warwick or Central Rhode Island?

Whether you’re considering a move in 2026 or just starting to plan, having a clear, local perspective matters more than ever. National forecasts provide context—but real estate decisions are always personal and local.

If you’d like to talk through your options, market timing, or neighborhood-specific trends, Nick Slocum and The Slocum Home Team at eXp Realty are here to help. Reach out anytime for a no-pressure conversation about what makes sense for you in the year ahead.