2026 Home Price Forecast: What It Means For Rhode Island Buyers And Sellers

Will home prices go up or down in 2026?

If you’re a homeowner or buyer in Warwick or anywhere in Central Rhode Island, you’ve probably been asking the same question as we head deeper into the year: what’s going to happen to home prices in 2026? After several years of dramatic swings—rapid appreciation, sharp interest rate increases, and uneven affordability—many people are hoping for clarity.

A recent nationwide roundup of 24 major housing forecast models offers a useful big-picture view. While no forecast is perfect, the consensus is clear: most economists expect modest home price growth in 2026, not a crash and not another runaway surge.

Below, we break down what the national forecasts are saying—and, more importantly, how they apply to Warwick, East Greenwich, Cranston, Coventry, North Kingstown, Providence, and the surrounding Rhode Island housing market.

The national outlook for home prices in 2026

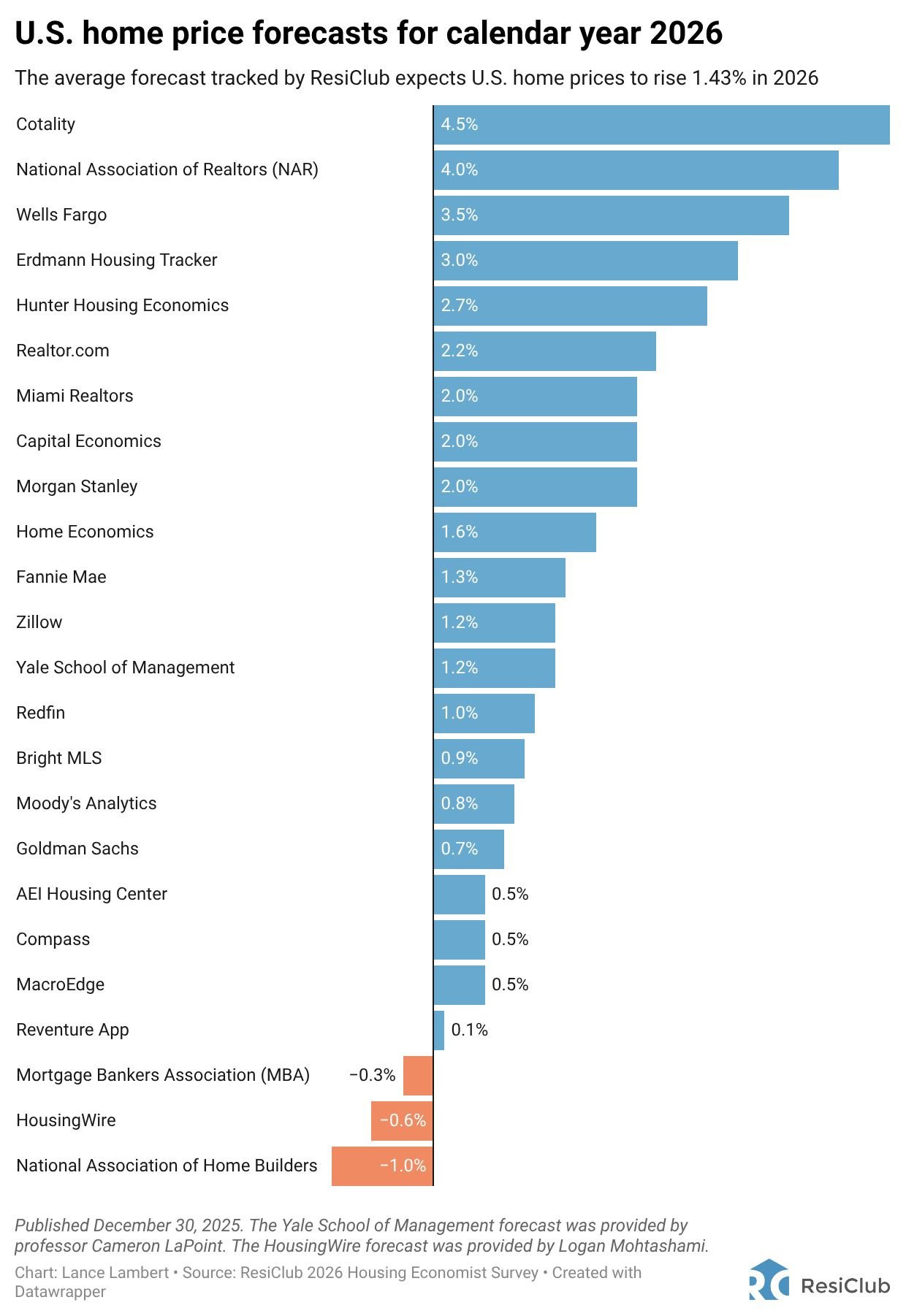

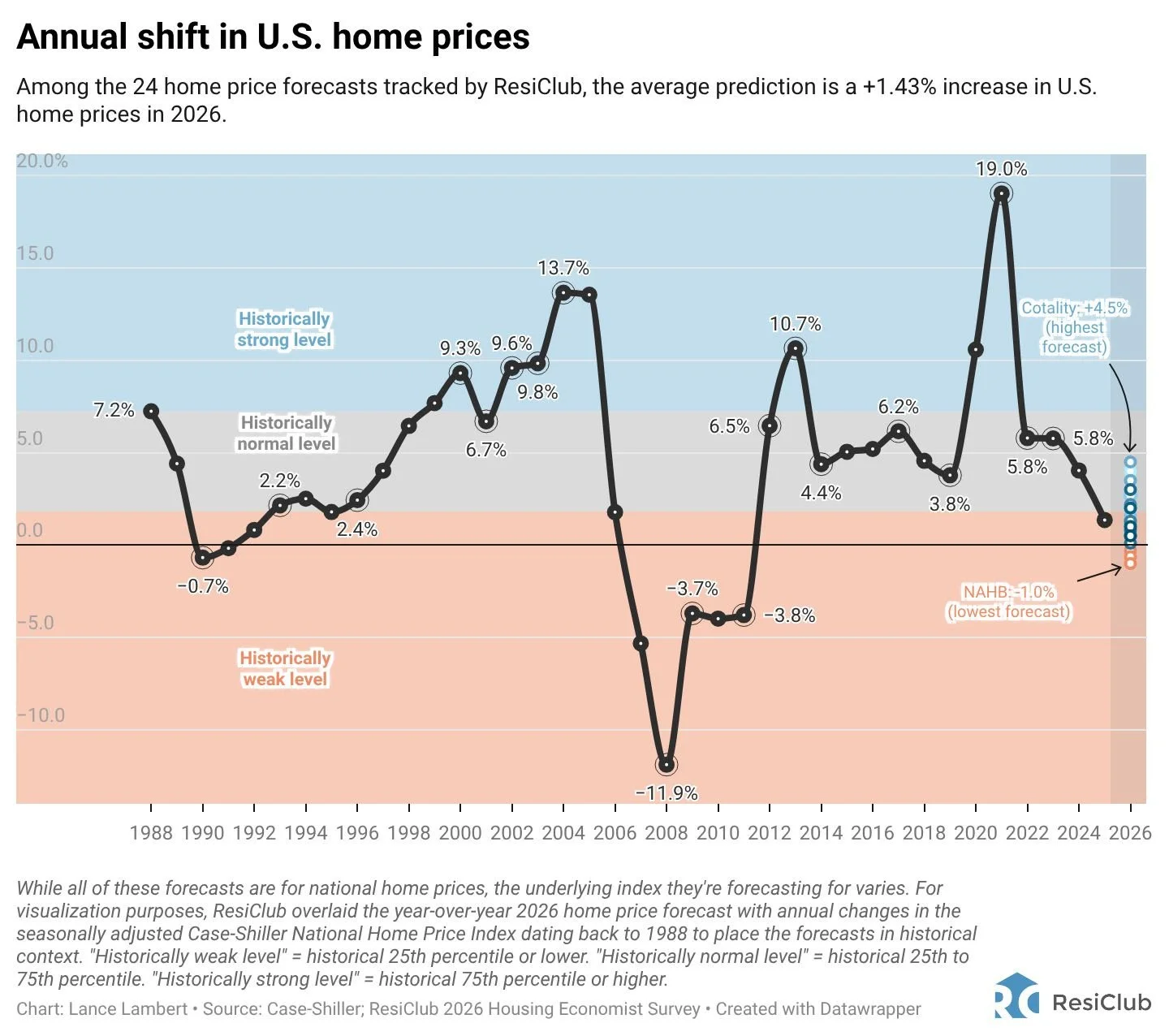

Across 24 different forecast models tracked by ResiClub, the average prediction is that U.S. home prices will rise about 1.43% in 2026. That’s a far cry from the double-digit gains of 2020–2022, but it’s still positive growth.

Here’s the key takeaway:

21 of the 24 forecasts expect prices to increase in 2026

Only 3 forecasts project a national price decline

In other words, the overwhelming majority of economists see a market that’s stabilizing rather than correcting sharply.

This slower pace of appreciation also means something important for buyers: home prices nationally are rising more slowly than income growth and inflation, which helps ease affordability pressure over time.

Why 2026 looks different than the past few years

To understand these forecasts, it helps to look at what’s changed.

1. Mortgage rates are no longer rising rapidly

Most economists expect mortgage rates to remain elevated compared to pre-2020 norms, but relatively stable, generally hovering around the mid-6% range. Stability—rather than dramatic rate drops—is what many models are built around.

That stability allows buyers and sellers to plan again, even if rates aren’t “cheap.”

2. Inventory is slowly improving—but still tight

While housing inventory has risen off historic lows, it remains well below long-term averages, especially in the Northeast. This ongoing supply constraint is one of the strongest reasons economists don’t expect meaningful nationwide price declines.

3. The market is becoming more regional

One of the most important points economists emphasize is that national averages hide big local differences. Some Sun Belt and Mountain West markets are still correcting after rapid pandemic-era growth, while many Northeast and Midwest markets are holding firm or continuing to grow.

What top forecasters are predicting

The forecasts for 2026 span a wide range, but most cluster in modest-positive territory:

More optimistic projections see prices rising between 3% and 4.5%, driven by tight supply and gradually improving affordability

Middle-of-the-road forecasts expect growth closer to 1%–2%, reflecting balanced conditions

The most cautious outlooks project flat prices or declines of less than 1%

Even among the most bearish models, the expectation is not a repeat of 2008-style declines. Several economists explicitly note that they expect any potential correction to be muted and localized, not national.

How this applies to Rhode Island and Central Rhode Island

National data is useful, but real estate is always local. Rhode Island—particularly Kent County and the greater Providence area—has several characteristics that tend to support price stability.

Limited housing supply

Rhode Island has long faced restricted new construction, and that hasn’t changed. Zoning constraints, limited land availability, and high construction costs all limit how quickly inventory can grow.

In communities like Warwick, East Greenwich, and Cranston, this ongoing supply shortage continues to put a floor under home prices.

Steady demand in established communities

Central Rhode Island remains attractive for buyers seeking:

Proximity to Providence

Access to highways and commuter routes

Coastal amenities and established neighborhoods

Even when national demand softens, these fundamentals tend to support consistent buyer interest.

Slower appreciation—but not declines

Locally, we’re seeing what many economists describe nationally: prices are no longer accelerating, but they’re also not falling sharply. Instead, the market is moving sideways to slightly upward, depending on price point, condition, and location.

Well-priced, move-in-ready homes in desirable neighborhoods continue to attract strong interest.

What 2026 means if you’re thinking of buying

For buyers, 2026 may feel less chaotic than the past few years—but patience and strategy still matter.

Potential advantages:

Less frenzied competition than peak pandemic years

More room for inspections and negotiations in some cases

Prices rising more slowly than wages, improving long-term affordability

Challenges remain:

Mortgage rates are still elevated by historical standards

Inventory is improving slowly, not flooding the market

The key is focusing on long-term fit rather than trying to perfectly time the market.

What 2026 means if you’re thinking of selling

For sellers, 2026 is shaping up to be a normalizing market, not a declining one.

That means:

Pricing correctly matters more than ever

Overpriced homes may sit longer

Homes that show well and are priced appropriately still sell

While you may not see rapid appreciation year-over-year, most forecasts suggest homeowners will continue to protect and gradually grow equity, especially in supply-constrained markets like Rhode Island.

The bottom line for Warwick and Rhode Island homeowners

The national consensus heading into 2026 points to modest home price growth, improving affordability, and a more balanced housing market. For Rhode Island, where supply remains tight and demand steady, this environment generally supports stability rather than decline.

Every neighborhood—and every home—is different. That’s why broad forecasts are best used as context, not decision-makers.

If you’re considering buying, selling, or just want a clearer picture of what your home could be worth in today’s market, local insight matters more than national headlines.

Thinking about making a move in 2026?

Whether you’re planning months ahead or just starting to explore your options, Nick Slocum and The Slocum Home Team | eXp Realty are here to help you understand the market and make confident, informed decisions.

Reach out anytime to talk through your goals and get a personalized look at the Warwick and Central Rhode Island housing market.