What Really Happens to Home Prices During a Recession? (Rhode Island Edition)

Are home prices going to crash if there's a recession? Should you wait to buy or sell your home in Rhode Island?

These are the questions we hear every day from our clients in Warwick, East Greenwich, Cranston, Coventry, North Kingstown, and across Central Rhode Island.

It's natural to feel cautious when the word "recession" pops up in the headlines. But before you hit pause on your real estate goals, let’s look at what the data—and history—actually show.

Here’s what you need to know about home prices during a recession and how it impacts buyers and sellers in today’s Rhode Island real estate market.

A Recession Doesn’t Mean Home Prices Will Crash

First, let’s bust the biggest myth:

👉 A recession is not the same as a housing crash.

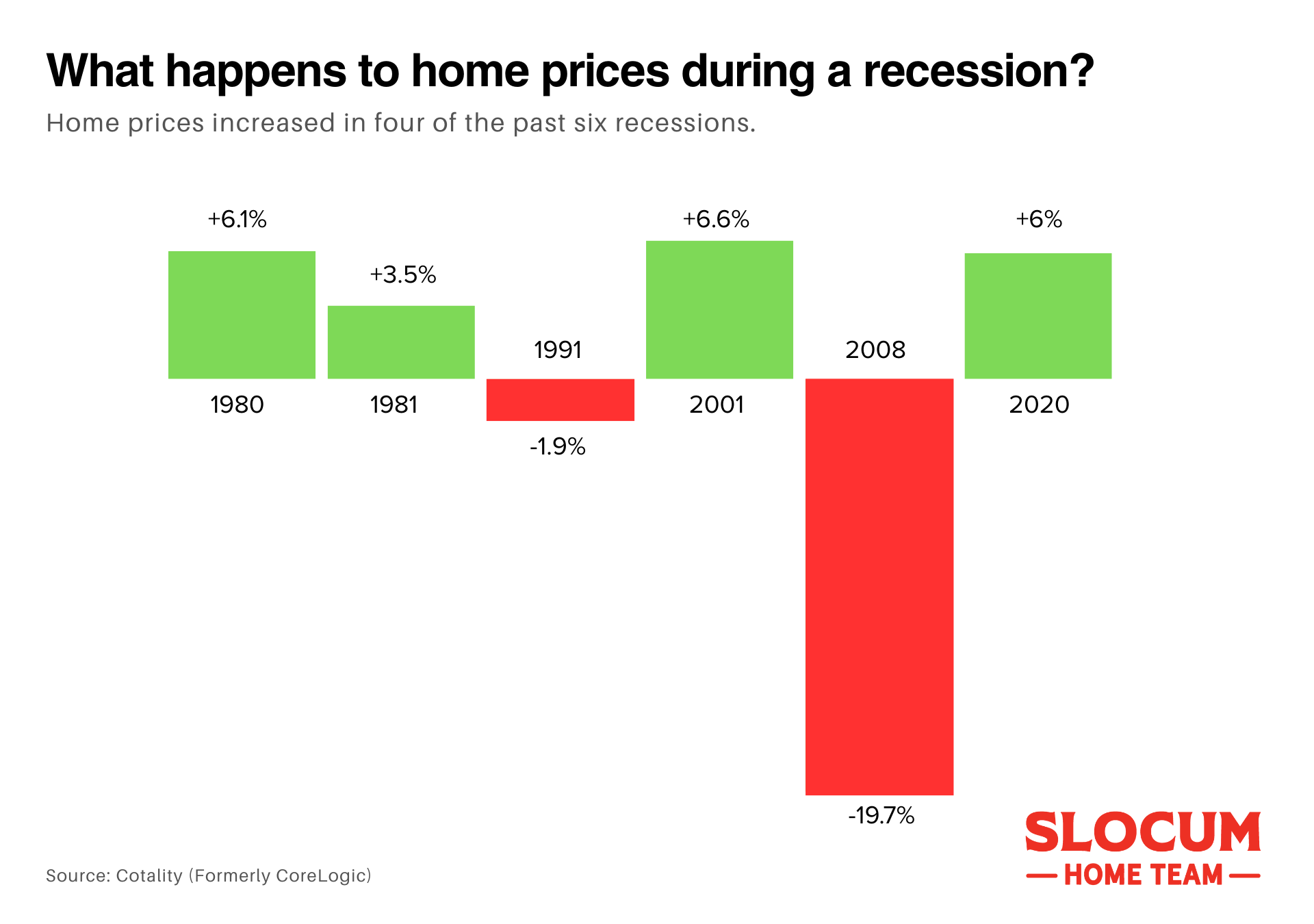

Historically, in 4 of the last 6 U.S. recessions, home prices actually increased. Even during the one recession where prices fell slightly, it was less than 2% nationally (source: Keeping Current Matters, Freddie Mac).

The only major exception? The 2008 financial crisis—but that was fueled by risky loans, speculative overbuilding, and a crumbling financial system, not just a typical economic slowdown.

Here in Rhode Island, the story has been even stronger. According to RI Statewide MLS data, median single-family home prices have continued to rise consistently:

2022: $402,000

2023: $425,000

2024: $475,000

That’s an 11.76% year-over-year gain just from 2023 to 2024 — during a period many worried was heading toward recession!

Mortgage Rates Usually Fall During a Recession

If you’re considering buying a home in Rhode Island, here’s some good news:

📉 Mortgage rates often go down during recessions.

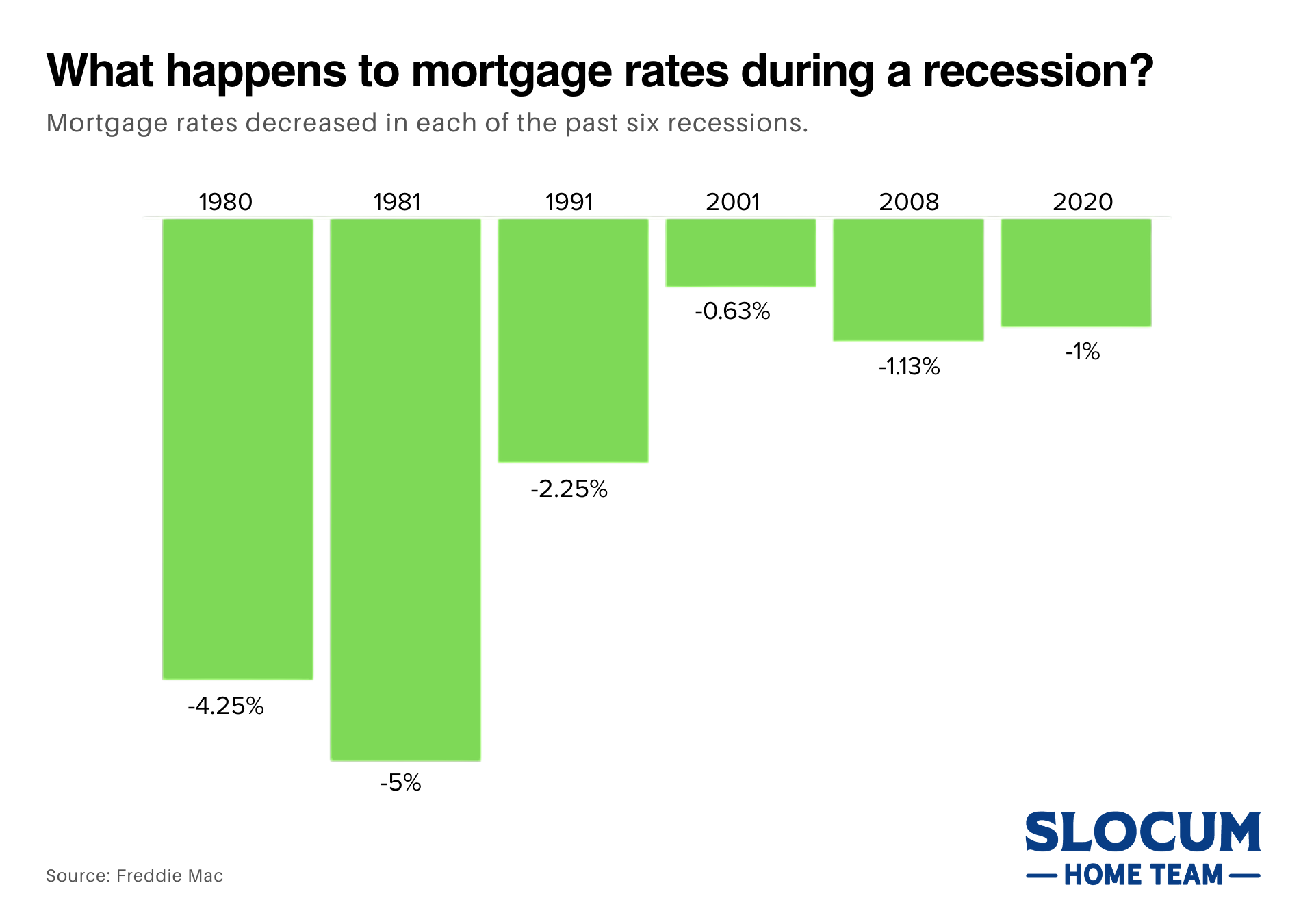

Every recession over the past 40 years has brought a decline in mortgage rates (source: Freddie Mac). That’s because the Federal Reserve typically lowers interest rates to stimulate the economy.

While we may not return to the record-low 3% rates of 2020, even modest decreases can significantly reduce your monthly payment.

Picture this:

On a $475,000 home, a 1% drop in interest rate could save you hundreds per month!

Homeowners Today Are in a Stronger Position

Another major difference between today and 2008? Home equity.

Thanks to years of price appreciation, homeowners across Warwick, East Greenwich, Cranston, Coventry, North Kingstown, and Providence have built substantial equity cushions. According to Realtor.com:

Even a 10–20% drop in home prices would still leave most owners with significant equity.

Plus, over 54% of U.S. homeowners have mortgage rates below 4%, meaning they're not desperate to sell and flood the market.

Translation:

No wave of foreclosures = No massive price crash.

Locally, our own Rhode Island MLS data backs this up.

Warwick’s median single-family price climbed from $377,000 in 2023 to $410,000 in 2024, an 8.75% increase—with no signs of distress selling.

Local Supply and Demand Remain Tight

Real estate always comes down to supply and demand—and in Rhode Island, inventory remains historically low.

New single-family listings rose slightly in 2024 but are still 22% below 2021 levels statewide

Average days on market statewide stayed steady at just 31 days

Tight inventory = Less downward pressure on home prices.

In Warwick, Cranston, and East Greenwich, demand continues to outpace supply, especially for homes priced below $600,000.

Bottom Line: Should You Wait to Buy or Sell in Rhode Island?

Waiting out the market based on scary headlines might actually cost you more. Here's why:

Buyers: If mortgage rates dip and prices continue to rise (as they have even during slowdowns), you could end up paying more later.

Sellers: You’re still in a strong position to sell at a premium while inventory remains low and buyer demand stays steady.

At the Slocum Home Team, we believe in strategic, informed moves—not fear-based decisions. Whether you're buying your first home, selling a luxury property, or investing in Central Rhode Island real estate, we’re here to guide you through it with expertise and care.

Final Thoughts: Don’t Let Fear Dictate Your Next Move

History shows us:

Home prices often stay stable—or even grow—during recessions.

Mortgage rates tend to fall, making buying more affordable.

Strong homeowner equity and tight inventory keep today's market resilient.

If you're thinking about buying or selling a home in Warwick, Cranston, Coventry, East Greenwich, North Kingstown, or anywhere in Rhode Island, let's talk.

Nick Slocum or one of The Slocum Home Team’s top agents will help you navigate today's market with confidence.

Reach out today for a personalized consultation—we're ready to help you move forward wisely, not fearfully.