Is It Better to Rent or Buy a Home in Rhode Island?

With home prices climbing and mortgage rates still high, many Rhode Islanders are asking the same question: Is it even worth trying to buy a home right now?

Let’s be real—renting can feel like the safer move these days. Maybe even the only move. And that’s a valid feeling. Buying a home in Warwick, Cranston, East Greenwich, or anywhere in Central Rhode Island isn’t something you should rush into. You should only move forward when you’re financially ready and the timing is right for your life.

But here’s the thing: While renting may feel like a smarter short-term option, it can quietly cost you more over time—without helping you build anything for your future.

The Real Cost of Renting in Rhode Island

A recent Bank of America survey revealed that 70% of aspiring homeowners are worried about what long-term renting means for their financial future. And they’re right to be concerned.

Why Renting Feels Cheaper (But Isn't)

Renting might feel more affordable today, especially when you compare monthly rent to a potential mortgage payment. But unlike owning, rent doesn’t come back to you later. It doesn’t build equity. It doesn’t generate wealth. It just pays your landlord’s mortgage—not yours.

And here in Rhode Island? Rent prices have followed a long-term upward trend, just like home prices. That kind of unpredictability can make it even harder to save for a down payment—creating a cycle that keeps many would-be buyers stuck renting longer than they want to.

Buying a Home in Rhode Island Builds Wealth Over Time

Owning a home is about more than just having a place to live. It’s a strategic way to build long-term financial stability.

Equity Gains and Rising Property Values

Over the years, home values in Warwick, North Kingstown, Coventry, and other Rhode Island towns have increased significantly. Even in years where growth slows, the overall trend points up. That appreciation builds equity—equity that becomes part of your net worth.

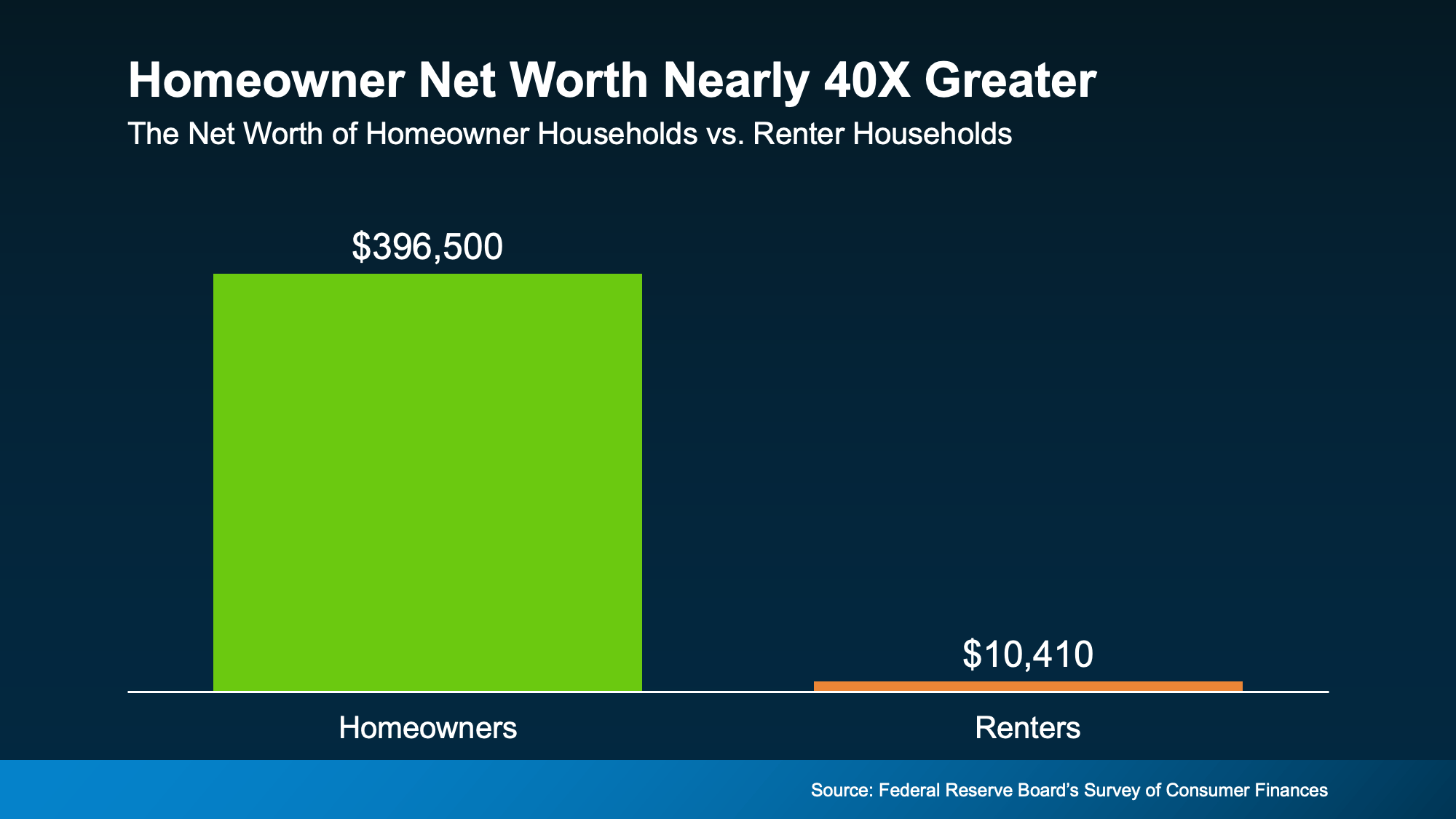

In fact, the average homeowner’s net worth is nearly 40 times greater than that of a renter. Let that sink in.

Every time you make a mortgage payment, you’re contributing to your own future. You’re not just writing a check and watching it disappear—you’re growing wealth month after month.

As Forbes put it best:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

So Why Does Renting Feel Easier?

Short-Term Convenience vs. Long-Term Return

Renting often comes with fewer responsibilities. No maintenance bills. No taxes. You can move without the process of selling. For many Rhode Islanders, especially first-time buyers, that flexibility is appealing.

But the trade-off? Zero return on investment.

Even as rents in Rhode Island have plateaued slightly in some areas, history shows they’ll likely rise again. And as rent goes up, your ability to save goes down. In fact, 72% of potential buyers in the same Bank of America study said rising rent is impacting their long-term finances.

So yes—renting may be easier today. But it’s harder on your future.

Whether You Rent or Own… You’re Paying a Mortgage

Let’s break it down.

Renting: Your monthly payment goes to your landlord. You gain no equity.

Owning: Your monthly payment builds your wealth, month after month.

The Big Question: Whose Mortgage Do You Want to Pay?

As the saying goes: You’re either paying your own mortgage or someone else’s.

If you live in Warwick, Cranston, or Providence and you’re unsure what the right move is, it might be time to sit down with Nick Slocum or one of The Slocum Home Team’s top agents and talk through your options.

What If Buying a Home in Rhode Island Feels Out of Reach?

That’s okay. Not everyone can—or should—jump in right away. But that doesn’t mean you should stay stuck.

Here’s What You Can Do Now:

Start a savings plan for a future down payment

Talk to a local lender to understand what you could afford—even if buying is 6–12 months away

Build or improve your credit score to qualify for better rates

Explore Rhode Island’s first-time buyer assistance programs

Partner with a real estate agent who will help you create a custom plan—not pressure you to act before you’re ready

Final Thoughts: Renting Might Be Easier Now—But It’s Not Always Smarter

Buying a home in Rhode Island isn’t the right move for everyone today. But if you’re thinking long-term—about your family, your finances, and your future—homeownership still offers advantages that renting simply can’t match.

And if you’re worried about navigating the market, we’ve got your back. The Slocum Home Team has been helping Rhode Islanders make smart real estate decisions for over 75 years. Whether you’re ready now or just starting to plan, we’re here when you need us.

Ready to Make a Plan?

Even if you're 6–12 months out, a conversation now can change everything later. Reach out to Nick Slocum or one of The Slocum Home Team’s top agents to start your personalized homeownership strategy—at your pace, and on your terms.