Is Waiting for a Recession a Smart Move in the Rhode Island Real Estate Market?

If you're thinking about buying or selling a home in Rhode Island—but holding off for a potential recession—you’re not alone. Economic uncertainty is prompting hesitation for many would-be movers in Warwick, East Greenwich, Cranston, and across the state. But is waiting really the best strategy?

Let’s break down what actually happens during a recession—and why waiting could cost you more than you think.

Are Buyers and Sellers in Rhode Island Pressing Pause?

According to recent national research from John Burns Research & Consulting and Keeping Current Matters, 68% of buyers and sellers are delaying their real estate plans due to concerns about the economy. But here's the twist: many aren’t holding off because they’re afraid—it’s because they’re hopeful.

They’re hoping a recession will lead to lower mortgage rates and maybe even better home prices. That logic sounds good in theory, but history tells a more complicated story.

Do Mortgage Rates Really Drop During a Recession?

In many cases—yes. During past U.S. recessions, mortgage rates have tended to decline. That’s because the Federal Reserve often lowers interest rates to stimulate economic activity. And that can trickle down to lower borrowing costs for consumers.

But while rate drops are common in recessions, they’re not guaranteed. Plus, rates don’t always fall enough—or stay low long enough—for buyers and sellers to benefit significantly.

In Central Rhode Island cities like Warwick and Cranston, homes are still moving, and the Slocum Home Team is seeing active competition even with fluctuating rates.

The Myth of Crashing Home Prices During a Recession

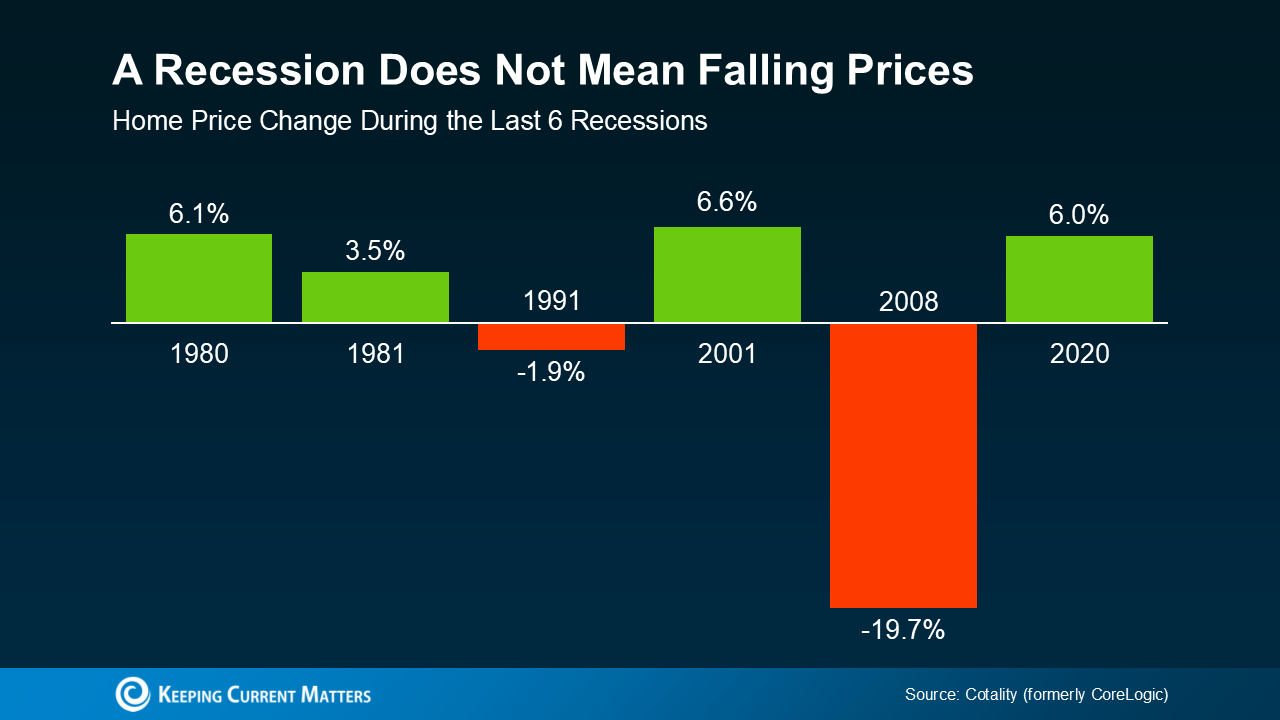

Many buyers assume a recession will bring falling home prices. But this assumption overlooks a crucial point: 2008 was the exception, not the rule.

According to housing data from Cotality (formerly CoreLogic), home prices actually increased during four of the last six U.S. recessions. Even when the economy slows, the housing market doesn't necessarily follow suit.

Why?

Because real estate—especially here in Rhode Island—is driven by local inventory and demand, not just national economic indicators. In fact, despite a recent uptick in listings, our market still faces a long-term inventory shortage2025 Selling SHT workin….

Today’s Market Still Favors Sellers in Many RI Towns

Even in a cooling market, many towns in Rhode Island remain in a low-inventory seller’s market. This includes popular areas like East Greenwich, North Kingstown, and Coventry.

Here’s what that means for you:

Buyers: Waiting might mean missing out. If rates fall, competition could spike—driving prices up again. Buying now means less competition and more negotiating room.

Sellers: Pricing remains strong in Central Rhode Island. If you wait, you might face more listings—and more competition—when others re-enter the market.

As Robert Frick, economist at Navy Federal Credit Union, explains:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point.”

Should You Time the Market or Take Action Now?

The Rhode Island real estate market isn’t a casino. It’s an asset class rooted in fundamentals—and in local knowledge.

If you’re buying, think long term. Consider your lifestyle, your financial picture, and the market realities—not just headlines.

If you’re selling, remember: your home’s value is based on current demand, recent comps, and inventory levels in your area. The Slocum Home Team helps homeowners across Warwick, East Greenwich, and Providence price strategically, even during uncertain times2025 Selling SHT workin….

What About Mortgage Rates in 2025?

While many experts believe rates could gradually decline, there’s no promise they’ll return to the historic lows we saw during the pandemic. And even if they do dip, you’ll likely face a flood of competition from buyers who were waiting on the sidelines.

That can lead to multiple-offer scenarios, fewer concessions, and rising home prices—offsetting any savings you might have gained from a lower rate.

Remember: you can refinance a mortgage, but you can’t change the price you paid for a home.

Bottom Line: Don’t Let “What Ifs” Delay Your Dreams

If you’ve been holding off on buying or selling because you're waiting for a recession to create the perfect conditions—don’t count on it.

Mortgage rates may go down—but home prices probably won’t.

Delaying could mean paying more, facing more competition, or missing the right home altogether.

The smartest move? Work with a local expert who knows the nuances of the Rhode Island market.

At the Slocum Home Team, we help you cut through the noise and make confident, informed decisions—whether you're buying your first home in Cranston, upgrading in East Greenwich, or downsizing in Warwick.

Let’s Make a Plan That Works—No Matter the Economy

Don’t wait for a perfect market. It might never come.

If you're thinking about buying or selling in Rhode Island, let’s have a strategic conversation. Nick Slocum or one of The Slocum Home Team’s top agents will help you evaluate your goals, review your timing, and decide whether now is the right time to move forward.

Because the best time to move isn’t when the headlines say so—it’s when you’re ready.