Could a 50-Year Mortgage Help Rhode Island Buyers — Or Just Stretch the Pain?

Housing affordability has been a tough headline in Rhode Island and across the country. So when ResiClub reported that the White House is weighing a 50-year mortgage option, it sparked a big question for buyers and sellers in Warwick, East Greenwich, Cranston, Coventry, North Kingstown, and Providence: would this actually help, or just kick the can down the road? ResiClub ran the math on what a 50-year product could mean. Below, we translate those insights for our local market and share practical next steps if you’re buying or selling a home in Rhode Island.

What’s being discussed (and what isn’t… yet)

ResiClub broke down “11 things to know” about a potential 50-year mortgage and why it’s even on the table: affordability is still tight and monthly payments remain the biggest hurdle for many buyers. Public chatter accelerated after federal officials acknowledged they’re exploring longer-term mortgages alongside ideas like portable or assumable loans. To be clear, this is not a finalized program; it’s an option under consideration, drawing both interest and criticism.

The payment math: a small monthly win, not a magic wand

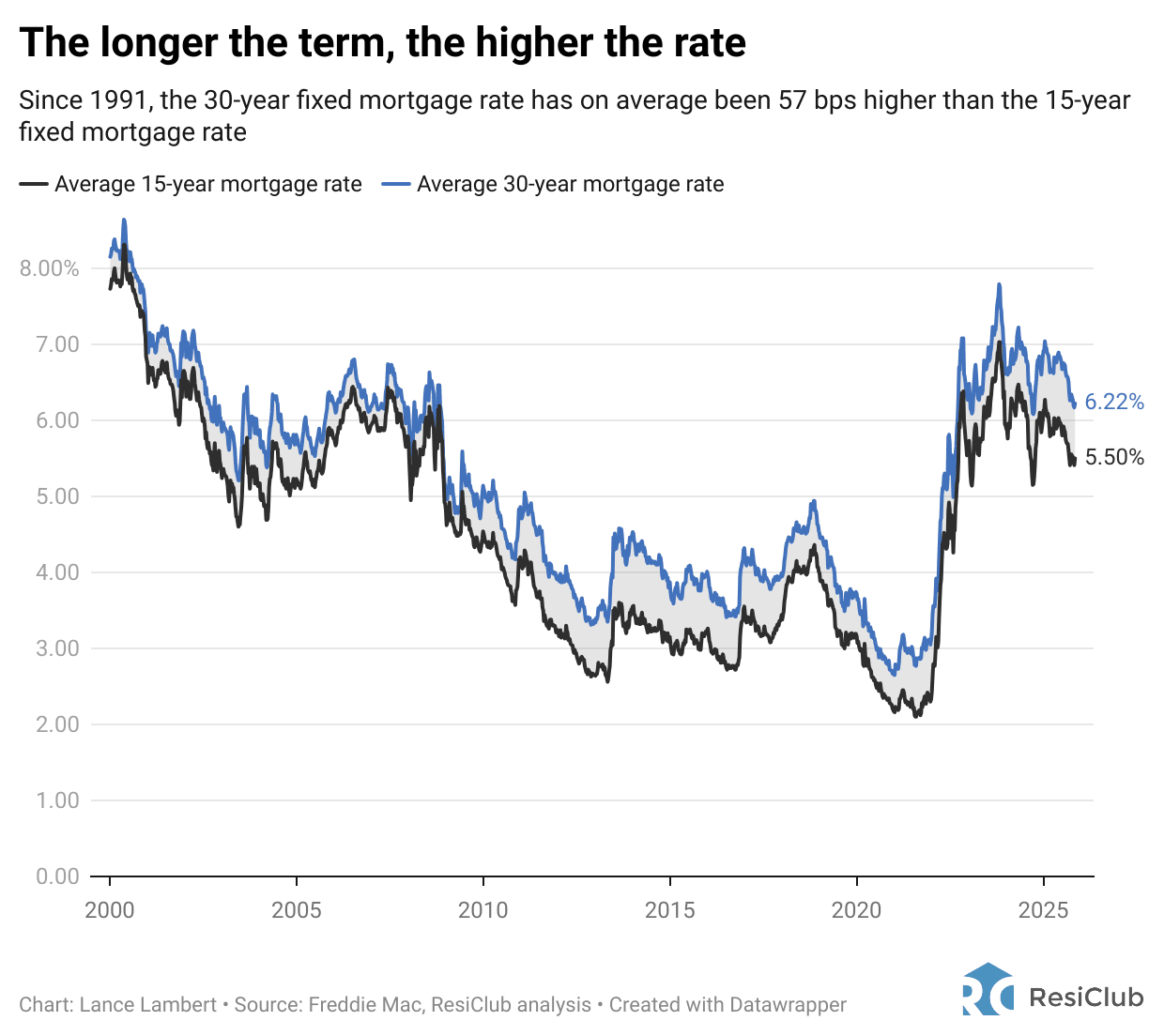

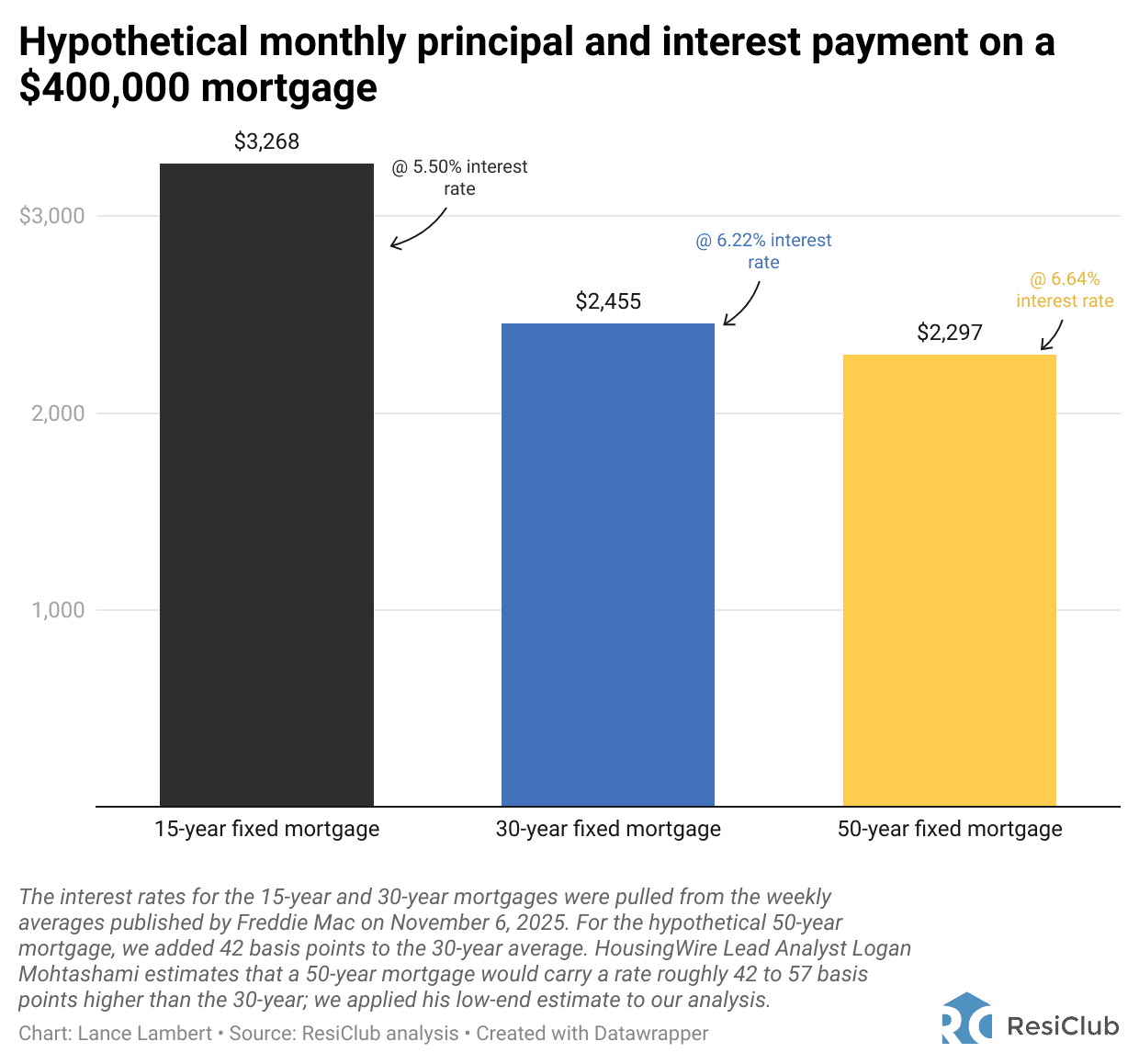

Rates would likely be higher than a 30-year. Longer terms carry more risk for lenders, so pricing typically includes a premium. Housing analyst Logan Mohtashami told ResiClub he estimates a 50-year fixed could run roughly 0.42 to 0.57 percentage points above the 30-year.

Where rates sit today. Recent 30-year averages have hovered in the low 6s. That’s the baseline any 50-year premium would stack on top of.

Example, simplified

On a $400,000 mortgage at 6.24 percent, principal and interest are about $2,463 per month. If a 50-year carried a roughly 0.5 percent premium, say 6.74 percent, the payment drops to around $2,304 per month. That’s a savings of about $159 monthly. It’s meaningful at the margins, though still a smaller swing than moving from a 15-year to a 30-year.

Bottom line: a 50-year lowers the monthly, but the trade-off is a longer debt tail and slower wealth-building through amortization.

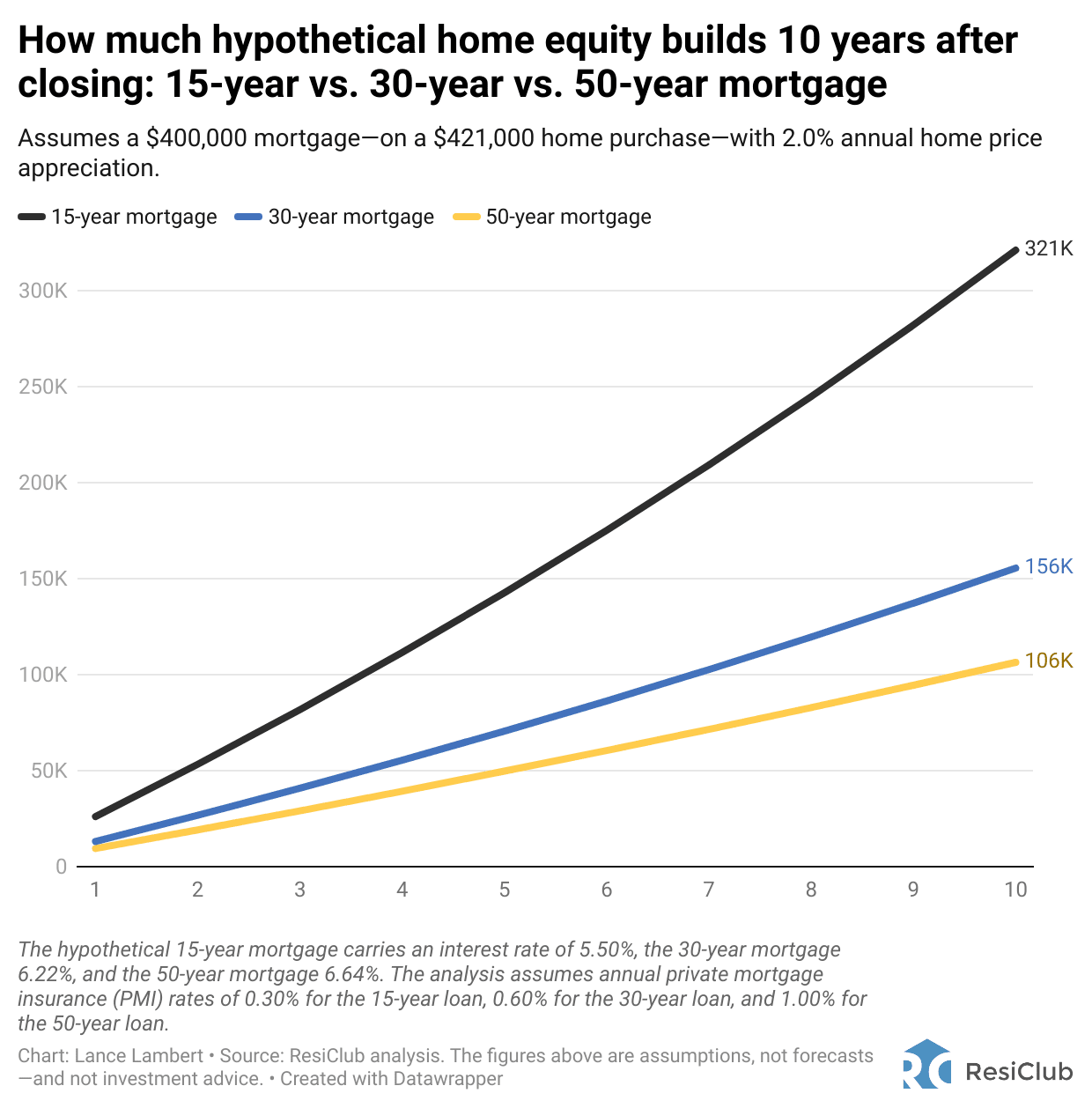

The long game: more interest, slower equity

Stretching the term dramatically increases total interest paid and slows equity build. If home prices cool or flatten for a period, owners on ultra-long terms can feel “stuck” longer because principal doesn’t fall as quickly — something ResiClub highlighted in their modeling.

That matters in Central Rhode Island where many move-up buyers in Warwick, Cranston, Coventry, and North Kingstown rely on equity from the last home to power the next one. Slower amortization means it takes longer to create that fuel.

“But most people don’t keep loans that long, right?”

Correct. Americans rarely hold a mortgage to maturity. Even with standard 30-year loans, many owners refinance, move, or pay off early. Practically, that means most borrowers would still exit or restructure well before year 50 — but they’d have paid more interest up front than on a 30-year.

Would a 50-year help Rhode Island first-time buyers?

Maybe a little. Lower monthly payments could bring some buyers in Warwick or Providence over the debt-to-income line. But several realities remain:

Down payment pressure doesn’t go away. A longer term doesn’t lower cash-to-close.

The monthly drop is modest. Helpful at the margins, not game-changing on most Central Rhode Island price points.

Equity builds slower. That can matter if you plan to sell and trade up in 5 to 7 years.

ResiClub’s read aligns with a growing chorus of economists: this could pull some buyers off the sidelines, but it’s not a cure-all, and it doesn’t address supply — a core driver of affordability from East Greenwich to North Kingstown.

Public sentiment is lukewarm

Early polling and coverage suggest mixed reactions. Supporters point to the monthly relief; critics call it a band-aid that risks keeping buyers in debt longer without solving inventory. That lukewarm response alone makes a rapid, national rollout less likely.

What this means if you’re buying a home in Rhode Island

1) Model today, then plan for optionality.

Whether you’re aiming in Warwick, Cranston, or Providence, underwrite your purchase on a 30-year with realistic taxes, insurance, and utilities. If a 50-year product ever appears — and you qualify — compare total cost and break-even for your expected holding period. Your Plan A should work without it.

2) Focus on interest-rate moves first.

A half-point rate drop on a standard 30-year often rivals or exceeds the monthly savings you’d get from stretching to 50 years with a premium rate. We’ll pressure-test this with you and your lender so you see the real trade-offs.

3) Strengthen the parts you control.

Improve credit to access better pricing.

Ask about seller credits in slower micro-markets.

Consider 2-1 buydowns or permanent buydowns; we’ll weigh short-term versus long-term math together.

4) Buy the home, not the hype.

ResiClub’s analysis shows the 50-year could help some fringe cases. But the bigger levers here in Rhode Island are price, condition, and timing. We’ll help you win the right house at the right number.

What this means if you’re selling a home in Rhode Island

1) Demand could bump at the margin — don’t bank on it.

If a 50-year option arrives, it might pull in a few more buyers at certain price points in Warwick or Cranston. But it’s unlikely to materially expand the pool. Your best strategy remains pricing, product presentation, and negotiation.

2) Price to the market you’re in, not the one you remember.

Sellers across the U.S. say pricing is where confidence is won or lost — and they usually remember how their agent made them feel during that decision. We use a structured pricing process and transparent comps so you understand the why behind the list price and the likely paths if conditions shift.

3) Expect longer tenures on the buy-side.

If your buyer arrives using a longer-amortization product, plan for slightly different appraisal, underwriting, or lock timelines. Our team coordinates early with lenders so surprises don’t derail your closing.

Local lens: Central Rhode Island realities

Inventory remains the story. From East Greenwich to North Kingstown, life-event sellers still drive listings, while move-up buyers weigh the payment gap between their current mortgage and a new loan in the 6s. Longer terms don’t close that gap as effectively as rate relief or price realism.

Luxury strategy is nuanced. In the upper tier — water views, new construction, premium neighborhoods — the buyer pool is thinner. Presentation, pre-market outreach, and intelligent pricing matter more than a new loan term existing in the marketplace.

First-time buyers need strategy, not slogans. The best results we’re seeing in Warwick and Cranston come from aligning search criteria with real underwriting numbers, leveraging credits, and being flexible on “must-haves” without compromising core needs.

If the 50-year option launches, who might it help most?

Payment-constrained buyers who qualify on debt-to-income with a longer term and plan to refinance when rates fall.

Stable-income renters in Warwick or Providence who value monthly slack more than rapid equity build, and who commit to investing the monthly savings outside the mortgage. ResiClub noted that’s a big if, but it’s where the math gets closer.

Who should be cautious:

Short-horizon buyers planning to move within 3 to 5 years.

Anyone counting on strong appreciation to do all the heavy lifting.

Buyers who won’t actually invest the monthly difference. The amortization drag can catch up quickly.

Our take for Rhode Island

ResiClub’s work frames the trade-offs well. A 50-year term can lower payments a bit, but it doesn’t fix inventory or meaningfully change affordability on its own. If it appears, we’ll evaluate it like any other tool in your plan — alongside rate buydowns, pricing strategy, and timing.

Until then, focus on controllables: credit, down payment structure, property selection, and negotiation. That’s how you win in Warwick, Cranston, East Greenwich, Coventry, North Kingstown, and Providence — regardless of the mortgage flavor of the month.

Ready to make your next move?

If you’re buying a home in Rhode Island or selling a home in Rhode Island, Nick Slocum — or one of The Slocum Home Team’s top agents — will run your numbers, map your options, and execute a clear plan. No fluff. Just strategy, service, and results.

Source acknowledged

This post summarizes and localizes ResiClub’s analysis and reporting on the potential introduction of a 50-year mortgage.