How Much Do You Really Need for a Down Payment in RI?

Wondering how much money you need to buy a home in Rhode Island? You’re not alone. With so much outdated information—and even more unsolicited advice from well-meaning family and friends—it’s no surprise that many buyers are confused about what it actually takes to become a homeowner in today’s market.

At the Slocum Home Team, we believe in arming buyers with facts—not myths. Whether you’re looking to buy in Warwick, East Greenwich, Cranston, Coventry, North Kingstown, or Providence, understanding your financing options and down payment requirements is a critical first step.

Let’s break it down.

Do You Need 20% Down to Buy a Home?

Short answer? No.

Despite what your uncle may have told you, most first-time buyers in Rhode Island and beyond do not put 20% down. In fact, the average down payment for first-time buyers has ranged from 6% to 9% in recent years.

Historically, that number has rarely hit 10%. The idea that 20% is required is simply a myth that keeps too many would-be homeowners on the sidelines.

For repeat buyers, the average is higher—about 23%—but that’s often because they’ve built up equity from a previous home sale.

What Are the Most Common Loan Types for RI Buyers?

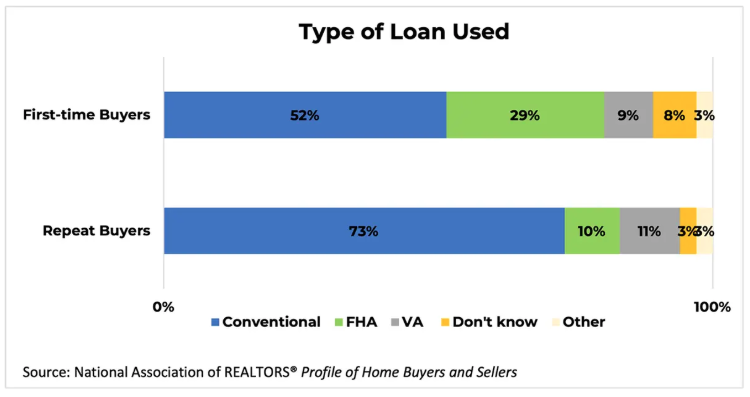

Here in Central Rhode Island, most buyers use conventional loans. But there are great alternatives—especially for first-time or lower down payment buyers:

FHA Loans: Require just 3.5% down

VA Loans: Require 0% down for eligible veterans

Conventional Loans with PMI: As little as 3% down, though you’ll pay private mortgage insurance until you reach 20% equity

Tip: If you’re not sure which loan program is right for you, talk to a lender—or reach out to Nick Slocum or one of the Slocum Home Team’s top agents. We’ll connect you with trusted mortgage partners who can walk you through your options in detail.

So Where Does the Down Payment Come From?

Most Rhode Island buyers lean on personal savings. But there are other sources too:

Savings from a bank or credit union

A gift from a family member

Retirement funds (401k, IRA), stocks, or even crypto

An inheritance

It’s also becoming more common for buyers to use multiple sources to gather the necessary funds. This is especially true in areas like Warwick and East Greenwich, where prices have risen in recent years.

What If I Don’t Have Enough Saved?

That’s where down payment assistance programs come in.

Rhode Island Housing offers various statewide options, and there are additional city-specific grants and forgivable loans that may be available. A resource like DownPaymentResource.com can help you find local programs, or you can talk to a knowledgeable Warwick Realtor like Nick Slocum for guidance.

These programs aren’t just for low-income buyers. Many are available to middle-class homebuyers who meet credit and occupancy guidelines.

Let’s Talk About Misconceptions

Many buyers still rely on advice from family and friends—even when those individuals won’t be living in the home or making the monthly payments.

The truth is:

Most first-time buyers don’t need 20% down

There are more loan options than ever

There are resources available—you just need to know where to look

That’s why working with an experienced team like the Slocum Home Team can make all the difference. We’ve helped hundreds of buyers navigate the Rhode Island real estate market with confidence, clarity, and a plan.

Why Are Today’s Buyers Still Struggling?

A new generation of buyers is facing more than just affordability challenges. Rent costs are rising. Saving while renting can feel impossible. And financial uncertainty—from inflation to student loans—makes the journey harder.

Some of the biggest hurdles for buyers today include:

Saving for a down payment

Monthly affordability

Economic uncertainty

Credit or debt concerns

These challenges aren’t unique to Rhode Island, but local guidance can make a huge impact.

Your Strategy: Start with a Buyer Consultation

At the Slocum Home Team, we’ve created a guided, 8-step home buying process that takes the fear and guesswork out of the equation. From pre-approval to negotiation and closing, our agents walk with you every step of the way.

Our buyers don’t just get access to listings—they get:

Mortgage referrals tailored to your situation

Down payment assistance program guidance

Support reviewing offers, contingencies, and local market stats

A proven team behind every step of the journey

Final Thoughts: You Don’t Need to Do This Alone

Whether you're buying your first home in Warwick or upgrading in East Greenwich, the most important thing to remember is this: you don’t need to save 20%, and you don’t need to figure it out alone.

The Slocum Home Team is here to help you make informed decisions and reach your real estate goals.

Ready to Buy in Rhode Island?

Let’s have a conversation. Contact Nick Slocum or one of our experienced local agents today and we’ll help you:

Understand your down payment options

Create a personalized plan

Make confident, informed decisions

Let’s turn your dream of homeownership into a reality—right here in Rhode Island.