2024 Housing Market Predictions

The 2024 Real Estate Market predictions have arrived, and they're sparking curiosity and debate!

Join us today as we dive deep into the future of real estate, exploring cutting-edge insights from industry leaders like Zillow, Redfin, The National Association of Realtors, Fannie Mae, and insights from market experts like Ryan Serhant.

The forecast? Intriguing, to say the least. Will 2024 bring a market upheaval reminiscent of the late 2000s Great Recession, or are we gearing up for a resurgence mirroring the booming early 2020s?

Let’s get started!

MORTGAGE RATES

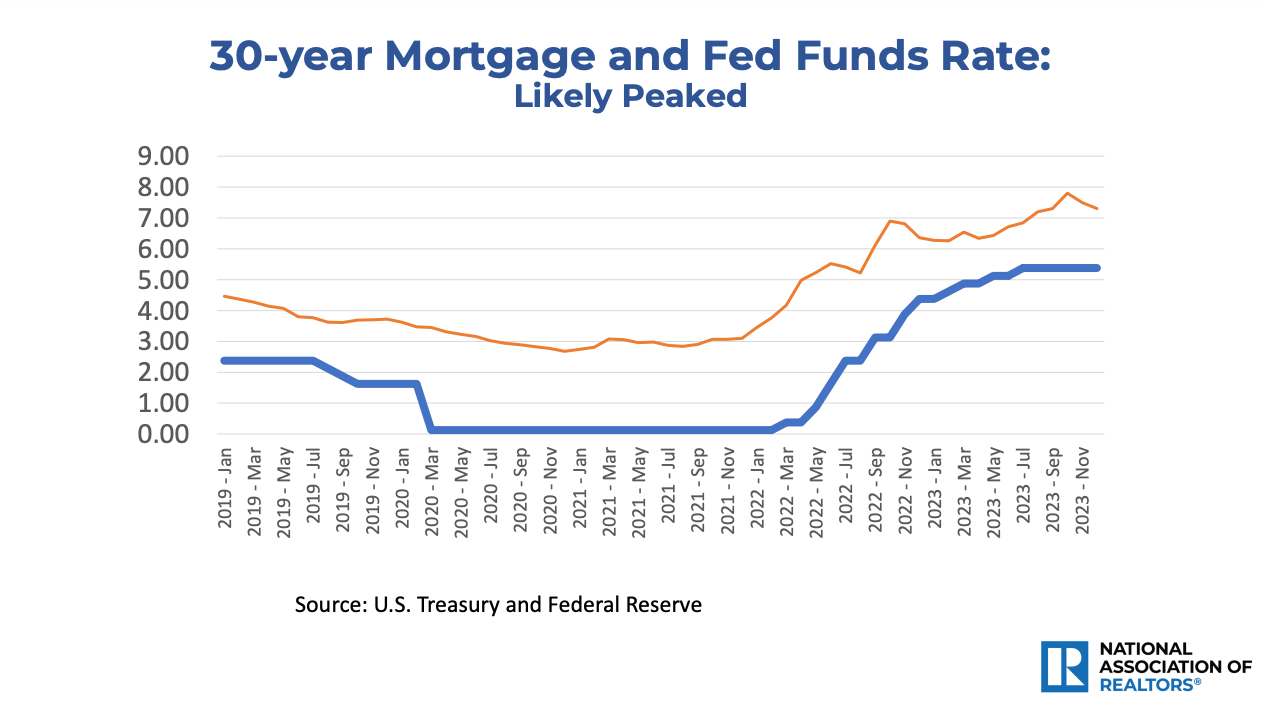

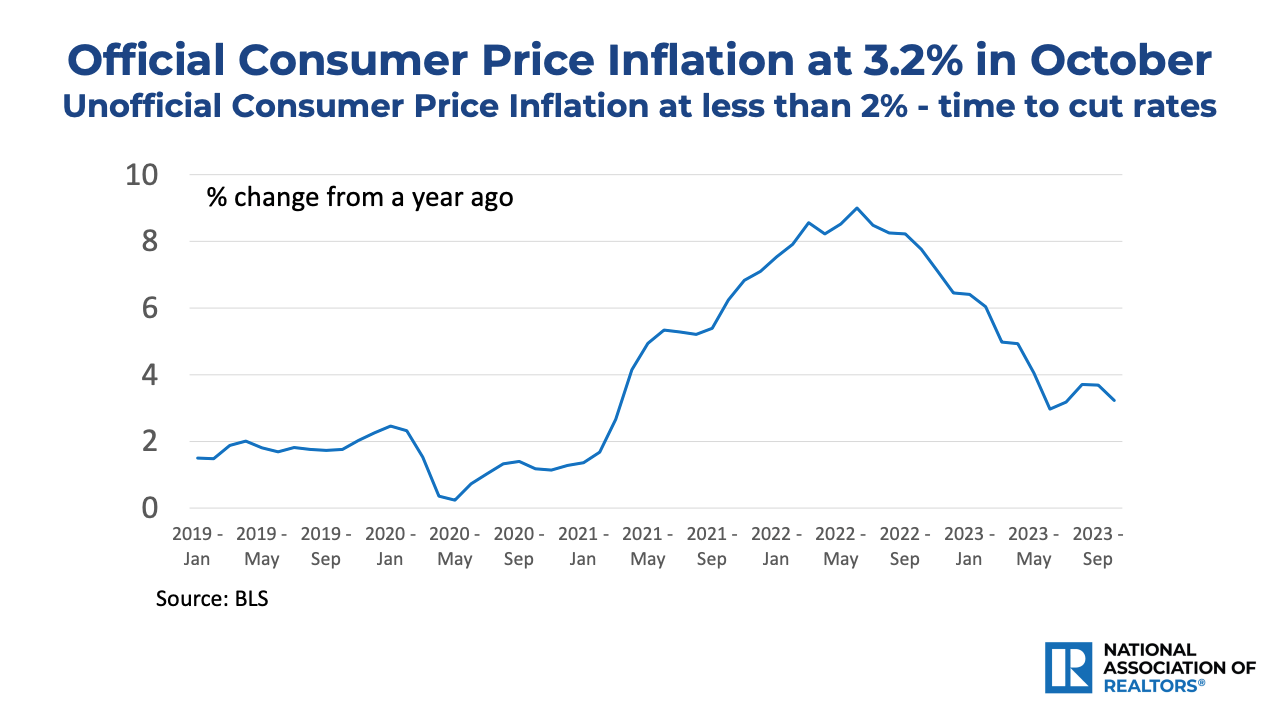

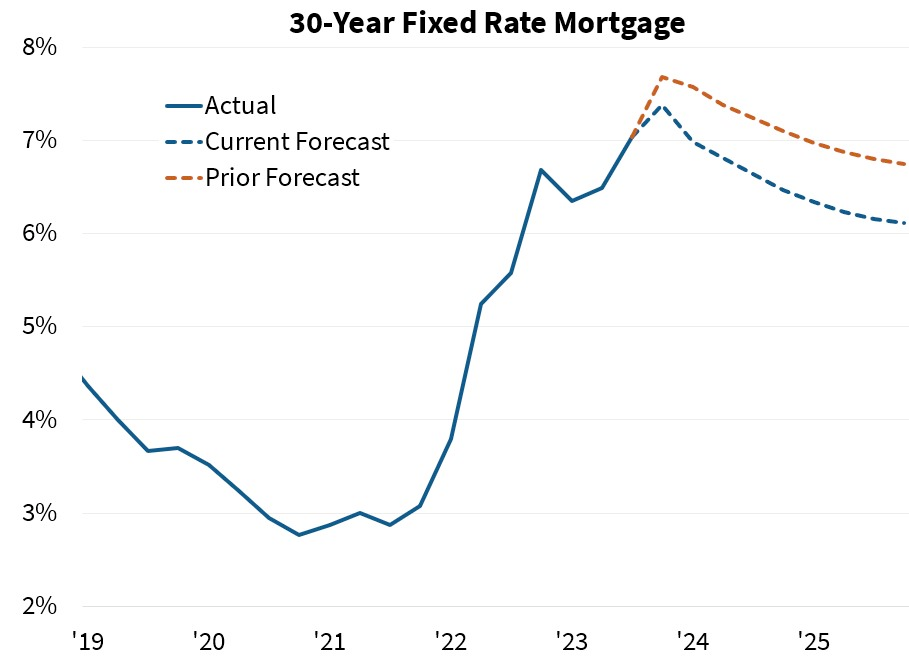

Diving into mortgage rates, a key driver of the real estate market. It's important to note that many of these predictions came before last week's historic drop in rates following the Federal Reserve's meeting.

The National Association of Realtors anticipates rates to average around 6.3 to 6.5% in 2024, potentially boosting housing affordability and drawing buyers back. However, they caution that if inflation doesn't ease, it could lead to higher long-term rates and impact sellers' decisions, possibly causing inventory constraints.

Ryan Serhant from 'Million Dollar Listing' expects interest rates to stabilize, indicating a steady economic environment. He doesn't foresee a significant rate drop, as it could reflect concerns about the economy's strength.

Fannie Mae foresees a further moderation in mortgage rates, contributing to a slight uptick in sales for 2024. This aligns with the recent trend of falling rates and suggests a modest but promising increase in market activity compared to 2023.

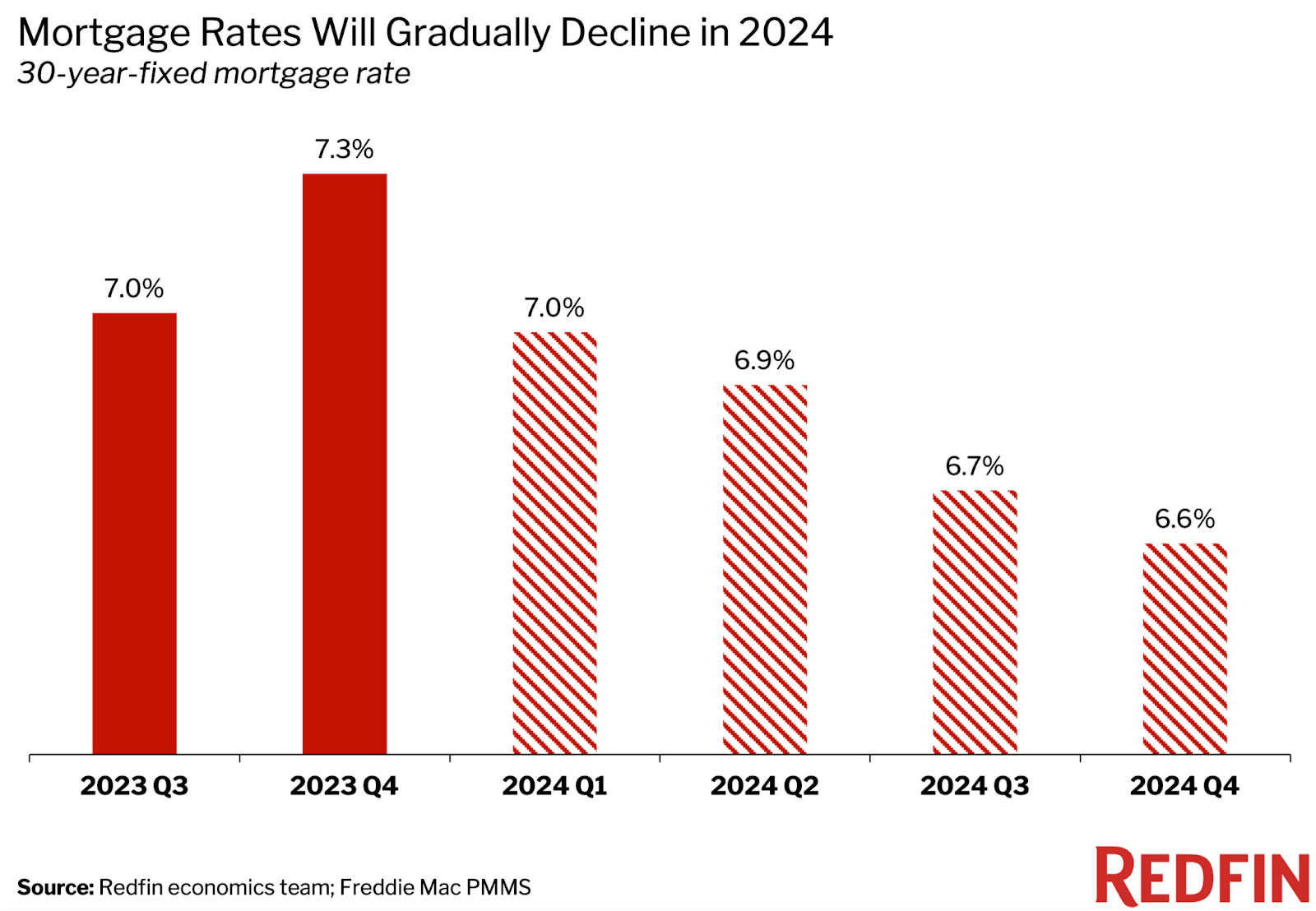

Redfin's analysis reveals that mortgage payments have hit an eight-month low, and this downtrend in mortgage rates is projected to stabilize and persist into 2024, averaging in the mid-6% range.

Similarly, Realtor.com predicts a consistent trend, with rates hovering in the mid-6% range as well.

HOME SALES

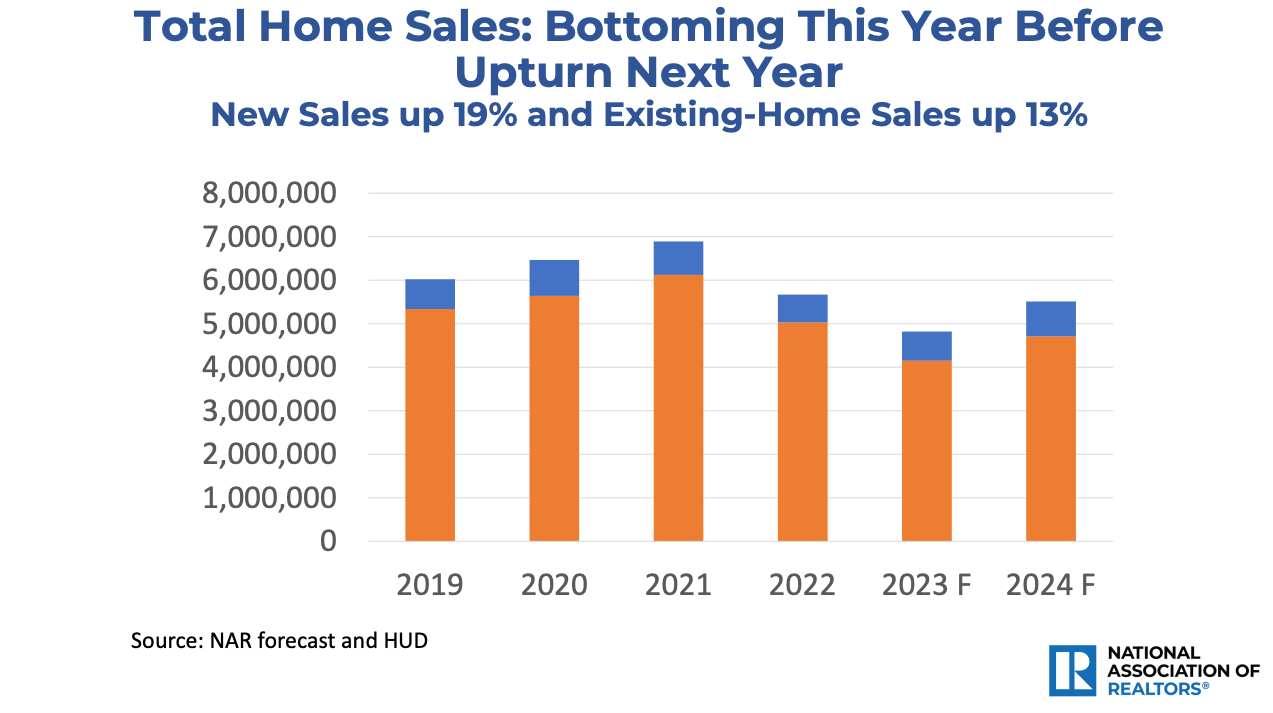

Next, we turn our attention to home sales, a vital pulse of the real estate market. The National Association of Realtors brings us a beacon of hope: after a two-year slump, existing-home sales are projected to make a strong comeback in 2024. NAR anticipates a substantial 13.5% increase in existing-home sales, complemented by a significant 19% boost in new-home sales. This growth, partly attributed to the easing mortgage rates, paints an optimistic picture for the market. However, they caution us – not all markets are created equal. Certain areas, buoyed by robust job growth, might experience a surge in sales, far outpacing others.

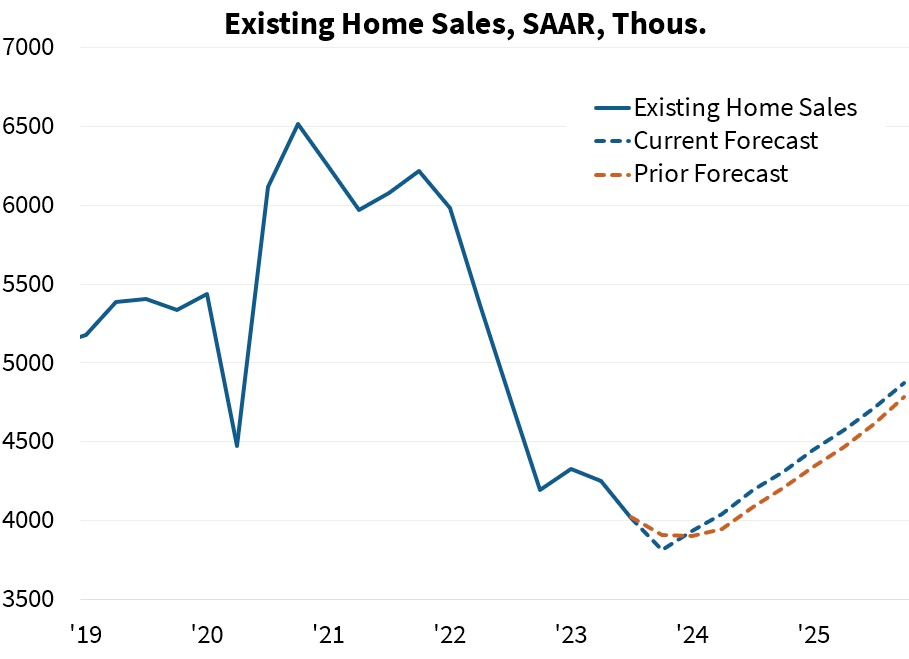

Fannie Mae offers a broader perspective, setting the scene with 2023’s home sales hitting their lowest since 2010. They forecast a gradual recovery in 2024, acknowledging the familiar challenges: unaffordability, homeowners clinging to low-rate mortgages (the lock-in effect), and a scarcity of available homes. These factors have put the market in a deep freeze, and while a thaw is expected, these issues will linger through 2024. Fannie Mae's prediction of only a marginal increase in 2024 sales over 2023 adds a note of cautious optimism to the mix.

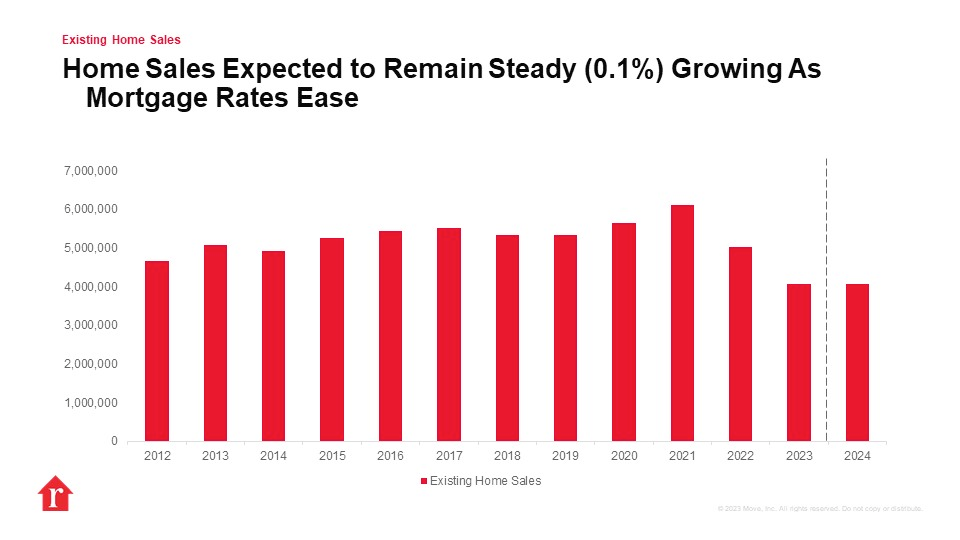

Realtor.com presents a somewhat subdued outlook. They expect home sales to just slightly surpass the record low of 2023, with projections hovering just over 4 million. The culprits? High costs and many homeowners' preference to hold onto their low-rate mortgages, creating a stable yet restrained sales environment. The limited number of homes for sale, coupled with inadequate new construction, suggests that inventory challenges will continue to shape the market.

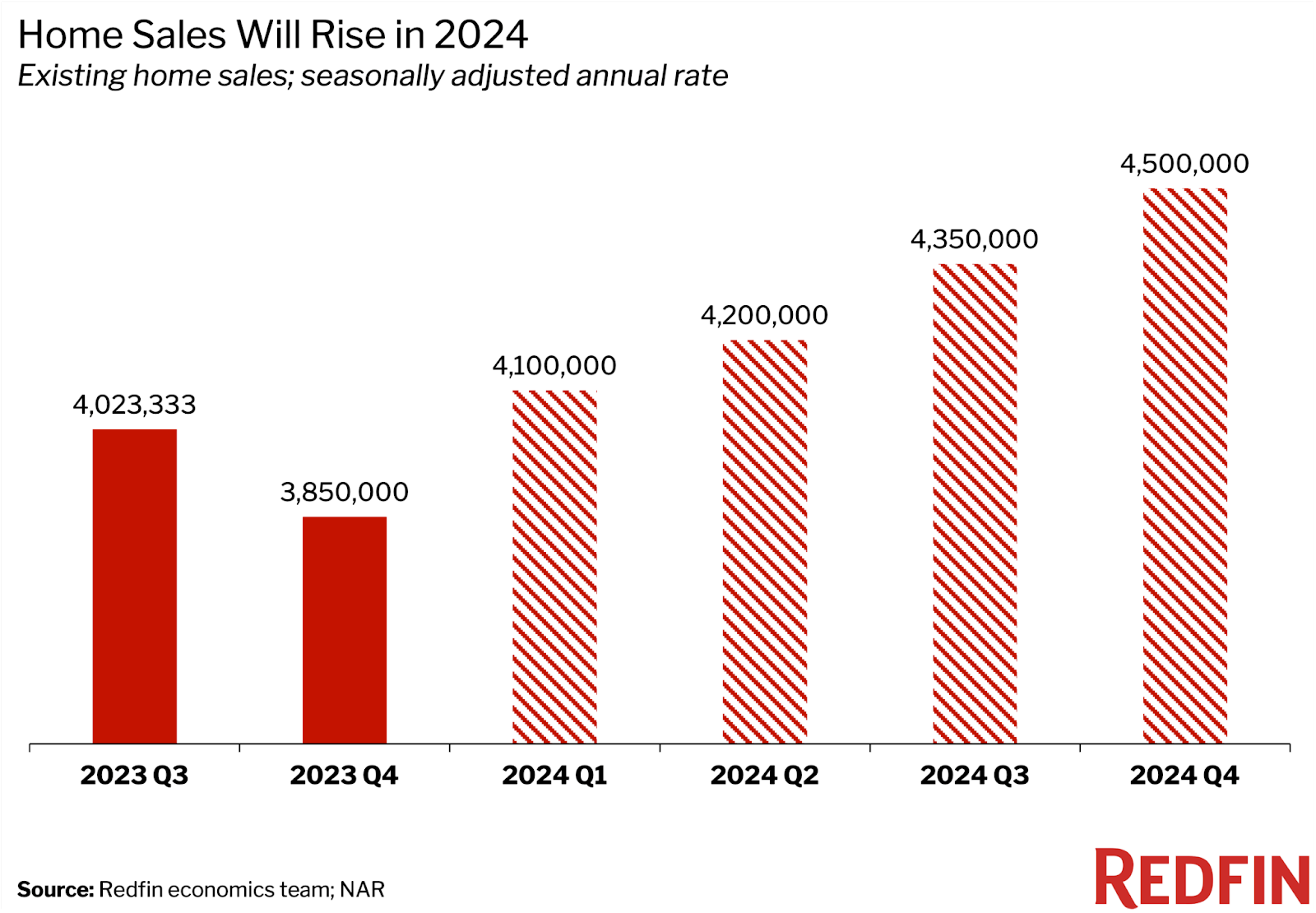

Redfin, however, injects a dose of positivity, forecasting a 5% increase in home sales for 2024. They attribute this rise to improved affordability and an uptick in home listings. This marks a stark contrast to the trends observed in 2023, hinting at a dynamic shift in the market as the year progresses.

Ivy Zelman provides rare insights, predicting a flat housing market activity for 2024, with a slight downturn in new home sales. She points to factors such as an aging population leading to increased vacancies, which might influence market dynamics. However, looking ahead to 2025, Zelman anticipates a modest rebound, with existing home sales rising by 7% from a very low base.

As we weave through these forecasts, a complex picture emerges. 2024 seems poised for a gradual recovery, but the path is nuanced, with different markets and housing types experiencing varying degrees of growth.

HOME VALUES

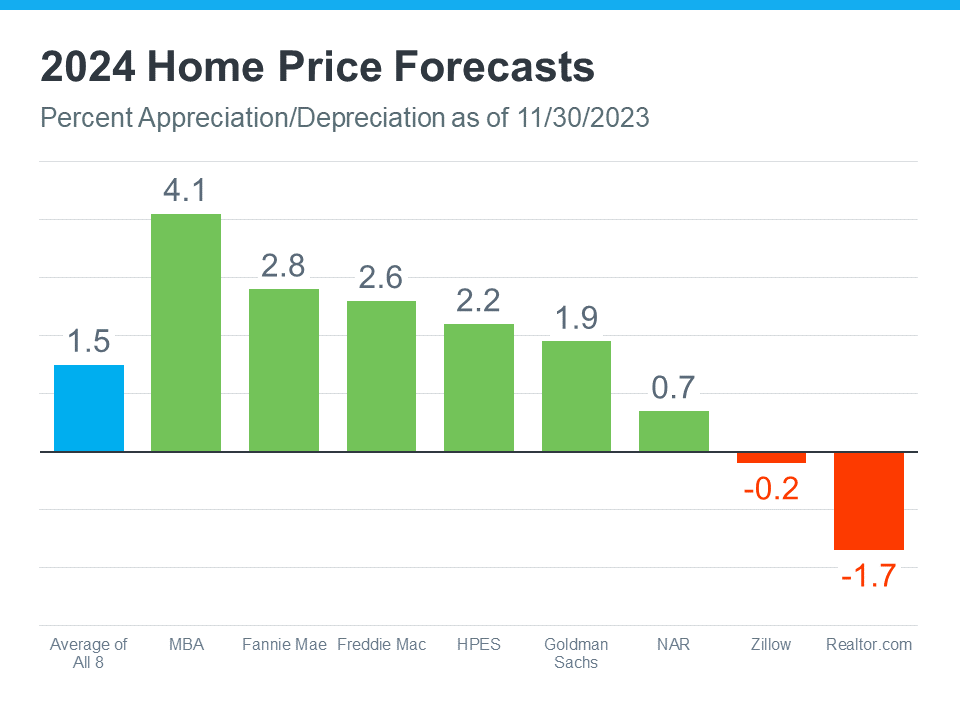

Shifting our focus to home values, a crucial aspect of the market. Zillow sets the stage for 2024 as a 'breather year' for homebuyers, predicting a slight 0.2% dip in values. This period of stability, with steady prices and rates, and an increase in market listings, could usher in a welcome phase of improved affordability, particularly as wages continue to grow.

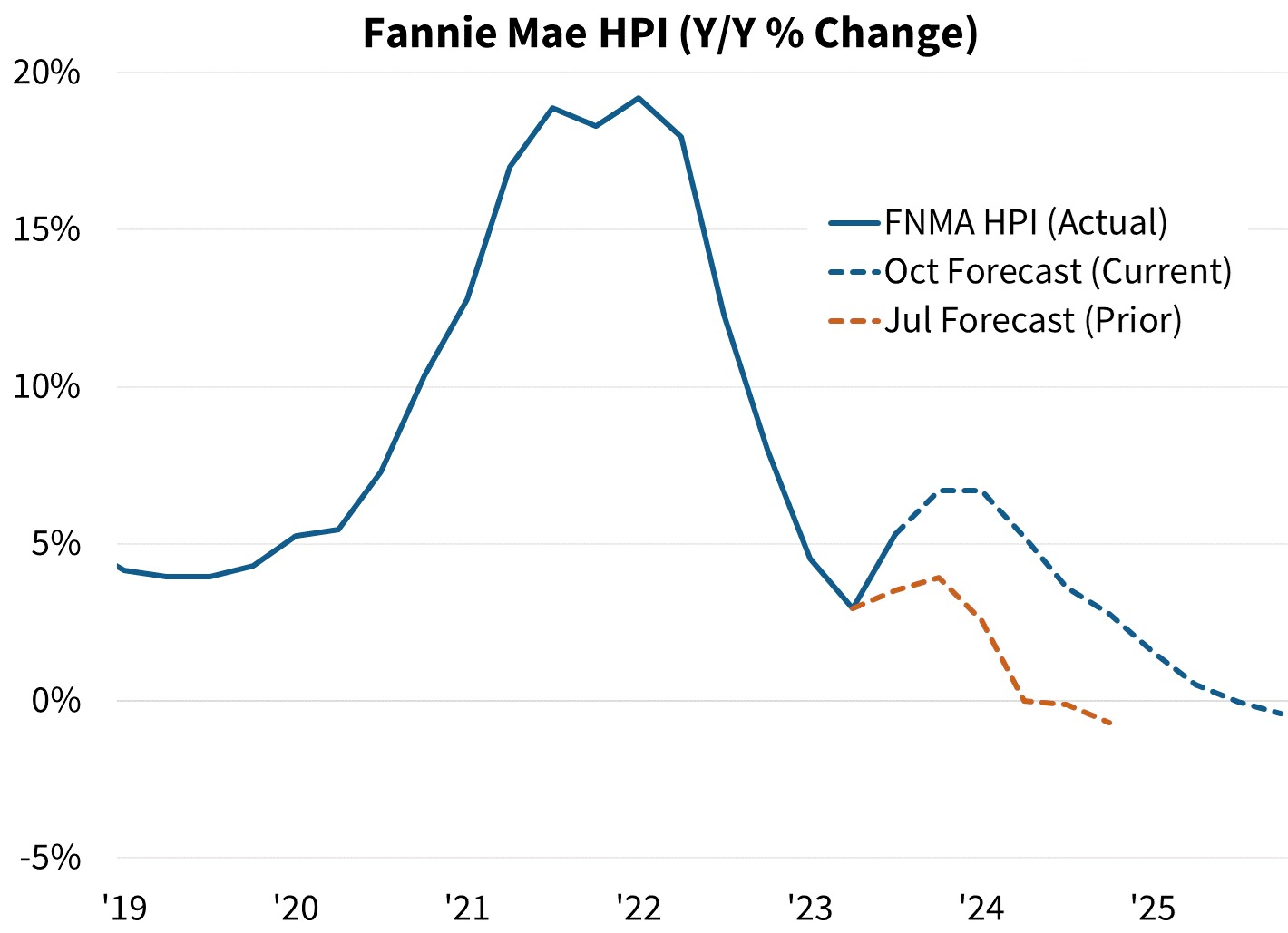

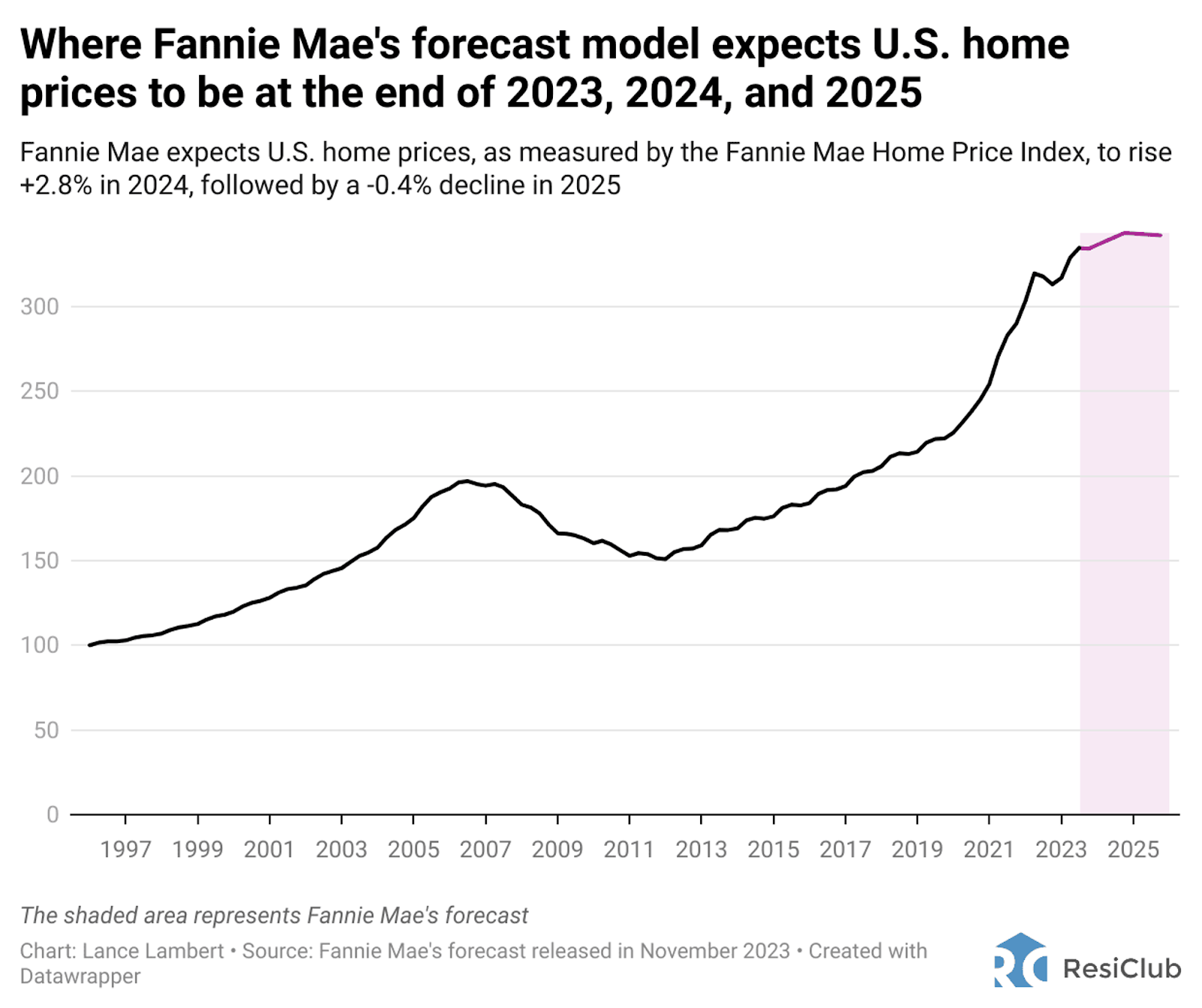

Fannie Mae observes a rebound in home prices from the mild declines of late 2022. Their forecast anticipates an increase in values in 2024, followed by a period of mild declines thereafter. This suggests a market that’s regaining its balance, adapting to the evolving economic landscape.

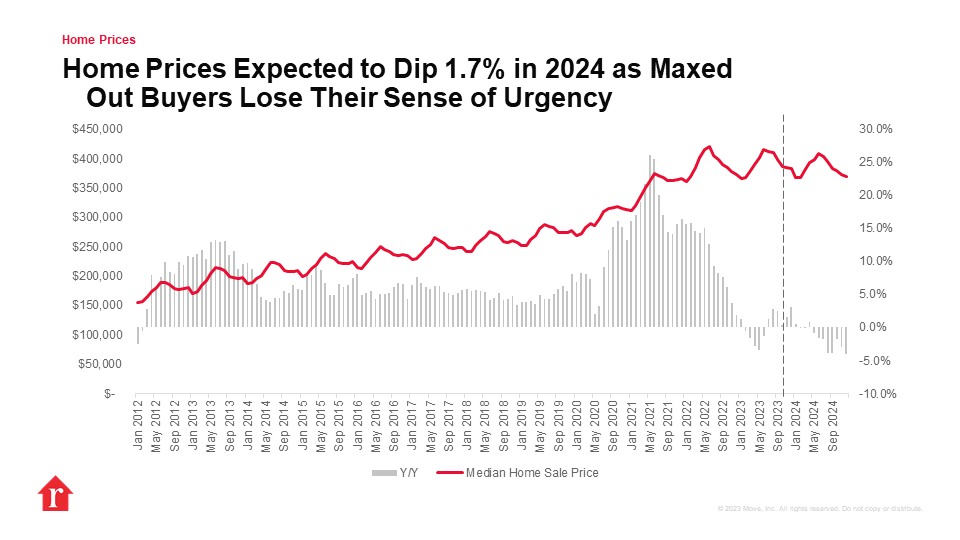

Realtor.com takes a more cautious stance, predicting a 1.7% decrease in home values for 2024. This decline, coupled with lower mortgage rates, could contribute to making housing more affordable, though prices will still be high relative to historical standards.

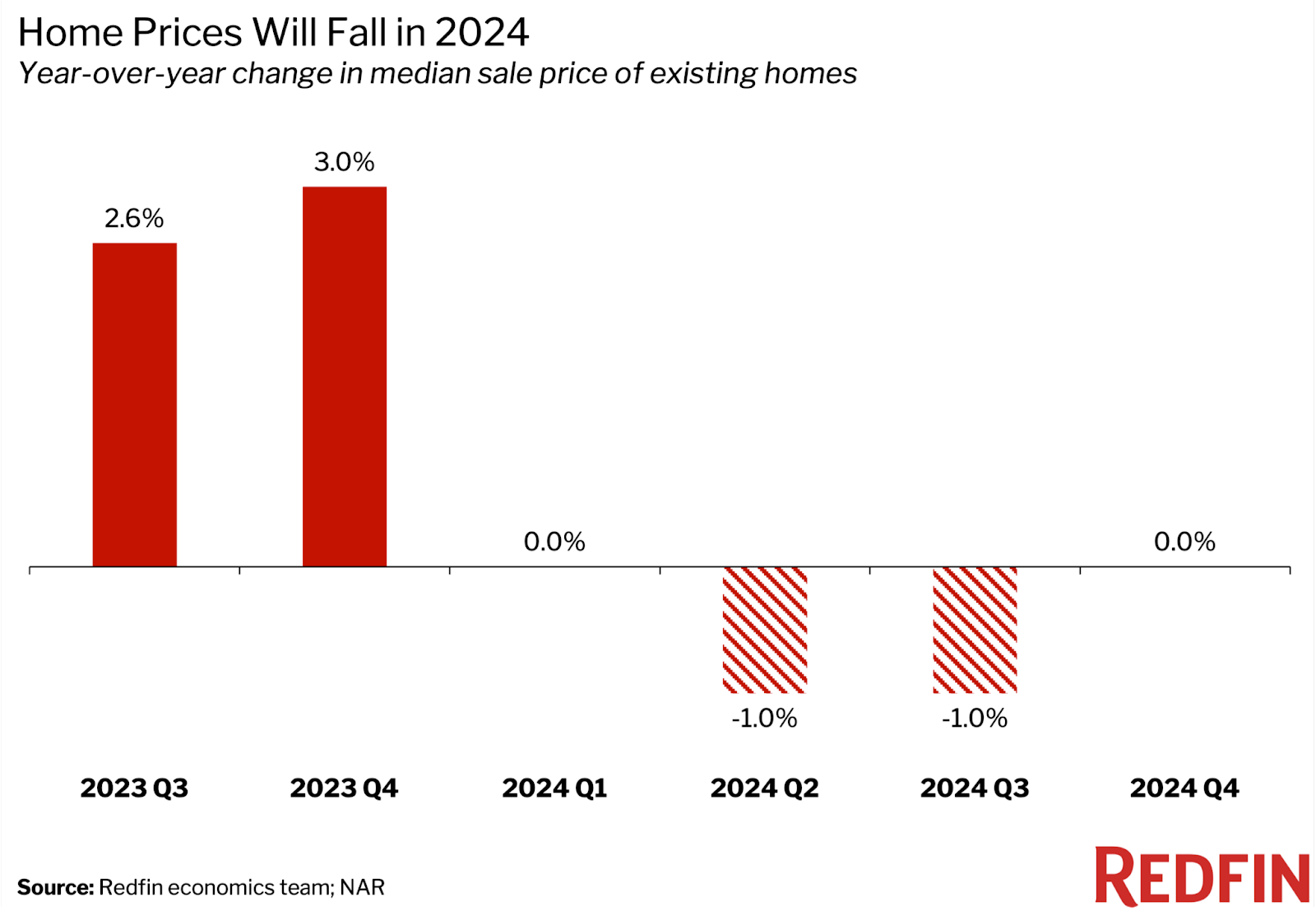

Redfin's analysis reveals a notable trend – a projected 1% year-over-year decrease in home prices during the second and third quarters of 2024. This would mark the first significant price drop since 2012, potentially easing the affordability crisis, albeit with home prices still posing a challenge for many.

Ryan Serhant offers a contrasting view, predicting an increase in prices amidst the current mortgage rates and affordability challenges. He attributes this to the ongoing inventory shortage, suggesting that as the economy stays robust and inventory remains tight, demand will outstrip supply, pushing prices upwards. He cautions that if mortgage rates fall, it could empower sellers further, potentially driving prices even higher.

The National Association of Realtors forecasts a modest increase in home prices, just under 1%. This slight rise indicates a market that’s cautiously optimistic yet mindful of the broader economic context.

BrightMLS projects a 1.5% rise in the median U.S. home price. However, they also note that growing affordability challenges, coupled with an increase in new home supply, might lead to price reductions in specific markets, such as California and Florida.

Altos Research adds another dimension, suggesting potential declines in home prices in 2024. This could be driven by economic risks and a gradual increase in home inventory.

As we piece together these varied predictions, it’s clear that the 2024 housing market will be a mosaic of regional trends, economic influences, and market dynamics. Home values will be at the heart of this, fluctuating in response to a multitude of factors. This complex landscape offers opportunities and challenges alike for buyers, sellers, and investors.

FURTHER THOUGHTS & Conclusion

As we approach the conclusion of our 2024 market analysis, let's reflect on some key insights and our predictions. The National Association of Realtors highlights that current homeowners have benefitted significantly from rapid home appreciation in recent years. This trend of wealth accumulation, in stark contrast to the financial experiences of renters, is expected to persist into 2024, even amidst potential market fluctuations.

Zillow's report suggests an interesting shift: more homeowners might list their properties in 2024, adapting to the reality of sustained high mortgage rates. This change could inject more homes into the market, potentially easing inventory constraints.

We're also anticipating a diverse range of market trends across different regions, influenced by factors like family changes and financial circumstances. This variability might lead to price declines in some areas, while others might see increases.

Now for our Prediction: We foresee a boost in sales, fueled by softening interest rates and a backlog of pent-up demand. Life's inevitable changes - encapsulated in the 10 D's of real estate: Diapers, Death, Divorce, Degrees, Diamonds, Dumpsters, Difficulties, Disabilities, Downsizing, Desks (new jobs) & one of my favorites… Dogs. will continue to be powerful drivers of movement. In our area, we expect a slight uptick in prices due to ongoing inventory challenges. Double-digit gains seem unlikely unless there's a significant drop in rates, which currently seems off the table.

'Will these bold predictions for 2024 hold up?' That’s the big question. What do you think? Dive into the comments with your perspectives. Don't forget to like, share, and subscribe for more insightful content, including our upcoming Rhode Island 2023 year in review. Stay informed, stay ahead, and let's navigate the future of real estate together!

Links:

Fannie Mae: https://www.fanniemae.com/research-and-insights/forecast/economic-developments-december-2023

Zillow’s 2024 Market Predictions: https://www.zillow.com/research/2024-housing-predictions-33447

Realtor.com: https://www.realtor.com/research/2024-national-housing-forecast

Redfin: https://www.redfin.com/news/housing-market-predictions-2024/

Ivy Zelman: https://nowbam.com/ivy-zelman-offers-rare-insights-on-the-housing-market/

Ryan Serhant: https://nowbam.com/8-predictions-from-ryan-serhant-on-the-2024-housing-market/

Altos Research: https://archive.is/afrs7

BrightMLS: https://www.brightmls.com/press-release/bright-mls-housing-forecast-2024-will-be-better-for-buyers

NAR: https://www.nar.realtor/magazine/real-estate-news/economists-turnaround-in-home-sales-likely-in-2024

Bottom Line

When buying a home, being informed about what to save for is key. Let’s connect so you’ll have an expert on your side to answer any questions you have along the way.